UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The advanced Q4 GDP report will come out on Janaury 30th and on the following day we will get the December PCE report. The December consumption numbers are critical, but we already have an idea where consumption growth will end up based on the retail sales report. We have every reason to believe this will be either an average or subpar GDP report.

The chart below shows expected contributions with GDP growth ending up at 1.9%.

The consumer will be important again, but not as important as the last two quarters. Capital Economics estimates consumption growth will push GDP growth up by 1.2%. Investment will add just 0.4% to growth. Net trade and inventory investment almost perfectly cancel each other out.

Obviously, this is just one estimate. The median of 12 estimates is 2.1% growth. As of January 17th, the Atlanta Fed called for 1.8% growth with consumption growth of 1.4% and real residential investment growth of 5.5%. The amazing December housing starts data will bolster the latter category. There was no economic data this past week that impacted the NY Fed’s model, so it still sees 1.22% growth in Q4 and 1.67% growth in Q1 2020. Finally, the St. Louis Nowcast is at 2.1%. It’s usually bullish, but not this time as that’s a reasonable estimate.

An Uptick In Forward EPS Estimates

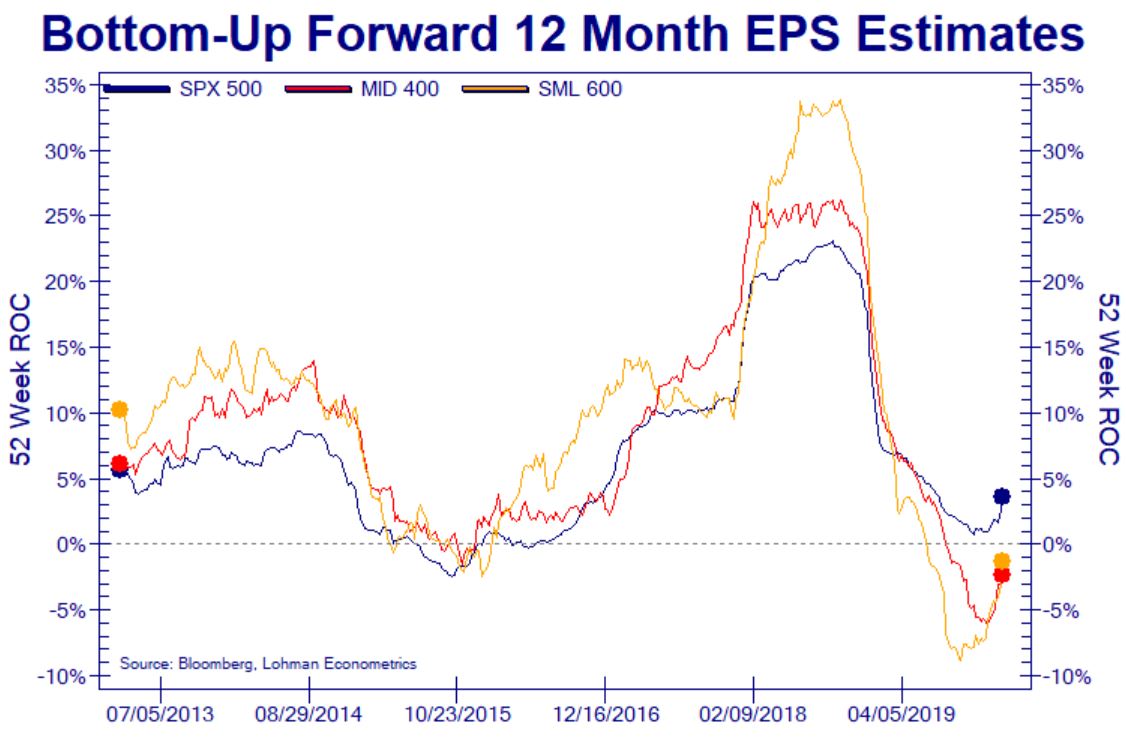

The rally in the past year has been predicated on an improvement in earnings growth. It’s finally happening as you can see from the chart below.

Estimates for large caps are calling for higher positive EPS growth and estimates for small and mid caps expect earnings to fall at a slower rate. Small caps have underperformed recently. 2020 will be the year of the earnings recovery. Since stocks have already priced this improvement in, you can see in real time why earnings growth doesn’t have a high R-squared with returns. If the stock market does its job correctly (anticipating future earnings), there won’t be a correlation with earnings and stock prices.

One interesting thought experiment is to ask if stocks can price in earnings slowdowns and expansions ahead of time, why even bother reacting to cyclical changes at all? Why not have always the same multiple because everyone knows there will be slowdowns and expansions? The answer is about who the buyers are. Corporations buy back their own stock and investors use cash to buy stock. If profits dwindle, buybacks fall even if firms issue debt to buy their stock back. We saw buybacks fall in the recent earnings recession. Yes, stocks still rallied, but obvious corporate demand plays a role. Individuals don’t have as much money to invest if they lose their jobs or if their businesses earn less money. That’s why having cash available in a recession and bear market is a privilege that you must make use of if you have it.

An Updated Review Of Q4 Earnings Season

Q4 earnings season has started to pickup as 85 firms have reported results as of Friday (147 firms report results this upcoming week). It has been a solid and unremarkable quarter. The non-GAAP EPS numbers make this GAAP earnings recession, not look like one at all.

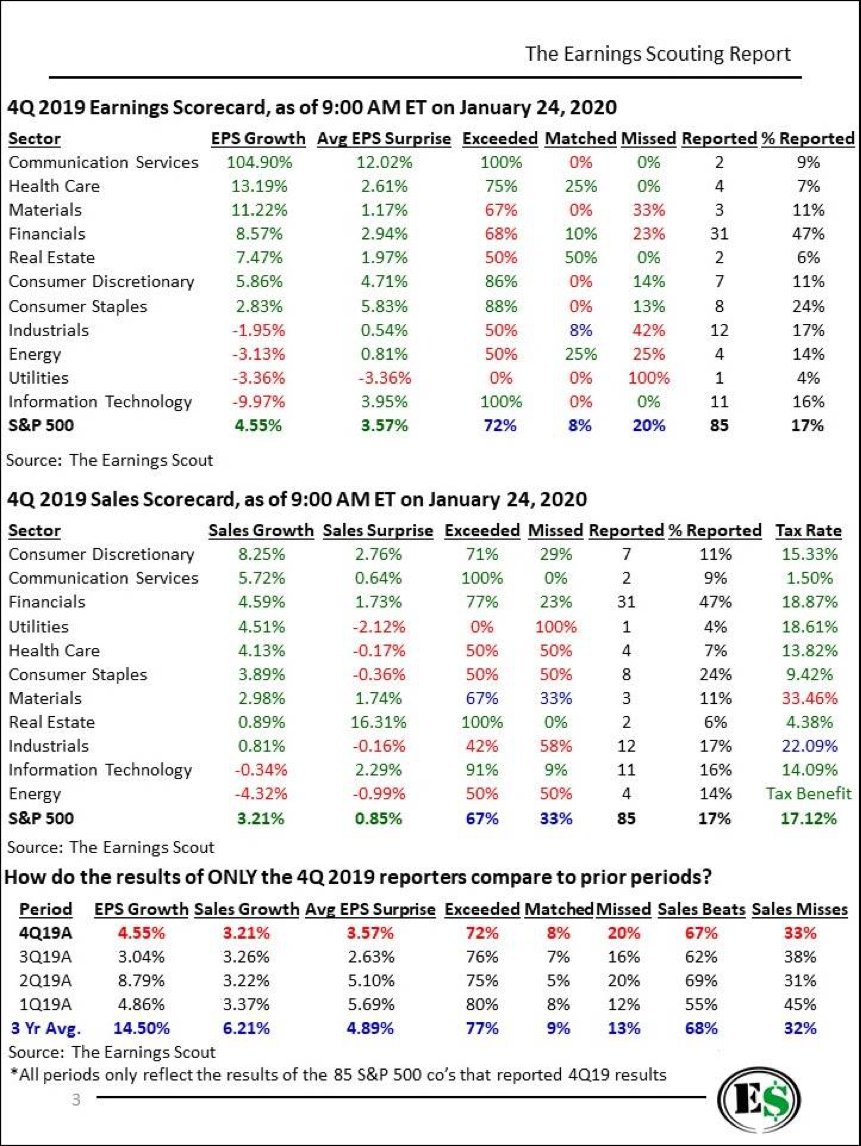

As the table below shows, EPS growth is 4.55% as the average surprise has been 3.57%. That average surprise is below the 3 year average of 4.89%, but above last quarter’s 2.63%.

Q3 was the trough in non-GAAP EPS growth as it was just 3.04%. EPS growth is back above sales growth as sales growth is 3.21%. Healthcare EPS growth is 13.19%, but few investors are focused on this. They are watching the Democratic primary to see if Bernie wins. The IHF healthcare ETF fell 2.08% on Friday. Bernie has a 39% chance of winning the primary according to PredictIt (Biden 35%). Here is yet another example where stocks aren’t directed by current EPS growth.

Looking at future estimates which are what affect current stock prices, 56% of the first 85 S&P 500 firms to report Q4 results had their Q1 estimates lowered afterwards. The average Q1 estimate change has been -1.31%.

10 Month High In Markit Flash PMI

The flash January Markit report measures the first 2 weeks of economic data in the month. Its composite PMI increased from 52.7 to 53.1 which is a 10 month high. As you can see from the chart below, the services index was up from 52.8 to 53.2 which is also a 10 month high.

The manufacturing PMI fell from 52.4 to 51.7 which is a 3 month low. This is different from the average of the first 4 regional Fed manufacturing reports (Philly, Empire, Kansas City, & Dallas) which has increased significantly. Remember, the Markit manufacturing PMI has recently been way above the ISM manufacturing PMI. The Markit manufacturing output index stayed at 52.4.

Service sector new orders growth fell slightly. Sales were up for the 3rd straight month. Business activity and employment growth improved. 1 year expectations increased to a 7 month high. Input price growth was the highest since July and output price growth was modest. That’s interesting because the CRB commodities index is down 5.3% year to date.

Within the manufacturing sector, new business growth was marginal. Both domestic and international demand weakened. New export orders were down for the first time since last September. Goods producers increased employment at the slowest pace in 4 months. Of course, most jobs are in services, so this isn’t a huge issue. Backlogs fell for the first time in 4 months. Input cost growth fell and output charges were only up slightly.

German & Japanese PMIs Increase

This was a good group of Markit flash reports. As you can see, from the chart below, Germany’s flash composite PMI rose from 50.2 to 51.1 which was a 5 month high. The services PMI of 54.2 and the manufacturing PMI of 45.2 where 5 and 11 month highs. Japan’s composite PMI rose from 48.6 to 51.1. Its services PMI rose from 49.4 to 52.1 and its manufacturing PMI rose 0.9 to 49.3.

Conclusion

Q4 GDP growth could be either near trend growth or below average. It won’t be strong. EPS growth estimates for the next year have improved because 2020 is the year of the earnings recovery. That doesn’t mean stocks will do incredibly well because returns and EPS growth don’t always correlate. The group of January Markit flash PMIs were good as Germany, America, and Japan’s composite indexes all improved.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.