UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The most important factor which determines if you successfully deal with a selloff is how you are positioned before one. When faced with a correction or a bear market your portfolio’s risk needs to be properly set to your personality, age, goals, savings and overall position in your life. It’s very tempting when starting a portfolio to take more risk when stocks are moving up and less risk when stocks are moving down. However, if you’re investing for the long term, there will be many of both scenarios. You need to visualize how you’d react when you make 20% in a year or lose 30% in 6 months. When deciding on the amount of risk you’re willing to take, one of the most important aspects is to avoid basing your choice on where you think the market will go up or down in the short term. You need to have a baseline plan for all markets to avoid scenarios where you panic. It’s easy to panic when you don’t have a plan in place. If your risk profile is wrong, you will likely underperform. Taking too much risk can cause quick painful losses. If you switch to a more conservative approach after you lost money, it will be difficult to make the money back.

Stay Disciplined

No matter how much you plan or how closely your portfolio matches your risk profile, if you want to go against your plan on a whim of a decision, it’s possible. There can be some circumstances where you need to wait a defined period before you can get your money back, but eventually you will be able to. You can override your personal financial advisor if you have one and you can take your money out of passive funds at inopportune times if you are making emotionally charged investing decissions. These are all mistakes you can make if you don’t follow through on your discipline. Recognizing you have the freedom to mess up your finances is daunting for some people who aren’t experienced. The key for inexperienced and even experienced investors is to take a methodical approach rather than being reactionary.

Have Plans For Various Scenarios

Having a generic plan if markets move how they usually do is not good enough. It’s very easy to maintain your equity positioning while stocks are going up 8% per year with a moderate amount of volatility along the way. It’s very difficult to maintain a plan when stocks are soaring or crashing. You’re going to feel the need to act in those circumstances. Instead of acting based on something you decided in the heat of the moment, come up with contingency plans before the volatility comes so that you can act rationally in the face of stress. It’s human instinct to fight or flight which in investing is taking on more risk or less risk. However, it’s best not to overreact.

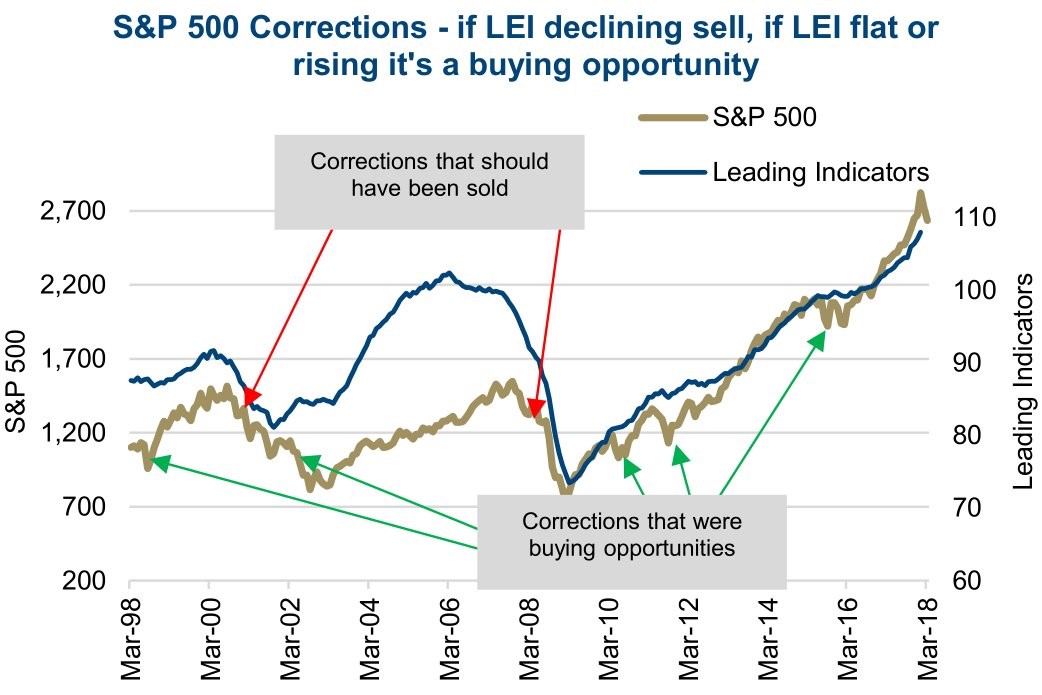

An example of what you can do when creating a contingency plan is to say, you will increase your US equity exposure by 5% if stocks fall 20% and 10% if stocks fall 40%. In this example, you would be adding new money to U.S. stocks or selling some of other parts of your portfolio in a tax preferable way to get more exposure to US equities. This is a relatively muted response, but it gives you the satisfaction of doing something in the face of panic. A second example, would be to sell 5% of your U.S. stocks when the Shiller PE is above 25 and the leading indicators are falling year over year and sell 10% when the Shiller PE is above 30 and the leading indicators are falling year over year. Notice how these examples fade major changes rather than follow them. In the near term, following trends makes sense, but when investing for decades, you can do the opposite of major equity price swings.

Brokerage Account: Price Isn’t Everything

The advice given thus far pertains to your overall asset allocation. Now let’s look at your brokerage account where you can have a percentage of your net worth in liquid assets to try to earn outsized profits. Clearly, the size of this portfolio as a percentage of your assets is based off the amount of risk you’re willing to take which is important as we mentioned earlier.

The first piece of advice, assuming you’re not day trading, which is an extremely risky strategy, is that price isn’t everything. Price is only one factor which changes. It is focused on because it is the most visible. However, fundamentals and value are very important as well. If a stock or a market was expensive in the past, a large selloff might not make it cheap. You can’t just buy the dip in something that was expensive because it might only be at fair market value rather than be cheap. Positive earnings reports that push a stock up might make it look overbought, but if the fundamentals improve, technical analysis is thrown out the window.

Avoid Emotion

There are so many emotions that go through an investor’s mind regardless of price action. Sometimes investors want to take more risk when they are underperforming the index or sometimes they are motivated to short a stock because they think the management team is making mistakes. These are all examples of making emotional decisions which will hurt your performance. It’s easy to tell people not to panic after a huge selloff, but that’s not helpful. The key is to be properly insulated to declines based on your risk profile. That way you won’t need anyone to console you during a period of increased volatility. In your brokerage account, avoid acting on emotion and price alone. Value and fundamental signals are more important than trend following in the long term. Make patience an edge you have which allows you to outperform the market.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.