UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The September Markit flash PMI fell 0.2 to 54.4 which is a 2 month low. It’s still in fine shape. As the economy improves, it’s tougher for PMIs to stay high because they ask how the economy is doing compared to the prior month. That’s how we saw such a sharp recovery in the PMI this spring as seen in the chart below. The services activity index fell 0.4 to 54.6 which also was a 2 month low. The chief business economist from Markit stated, “US businesses reported a solid end to the third quarter, with demand growing at a steepening rate to fuel a further recovery of output and employment.”

The manufacturing sector is improving quickly as it is known to do. That’s especially the case in this cycle because goods sales have beaten out services sales due to the pandemic. Manufacturing is always deemed an essential service, while services aren’t always essential (bars & restaurants). The manufacturing PMI rose from 53.1 to 53.5 which is a 20 month high. Manufacturing output hit a 10 month high. It’s not just this report showing strength. We already discussed in a previous article, that the Empire Fed manufacturing index rose from 3.7 to 17. In addition to that, the Richmond Fed index rose from 18 to 21.

Fed Doesn’t See Inflation Getting To 2% Soon

The Philly Fed index fell slightly from 17.2 to 15. However, the expectations index was up from 38.8 to 56.6. That increase was mostly driven by higher prices which is shocking because of how low everyone thinks inflation is. In fact, FOMC member, Rosengren said “We’d be lucky to get 2% inflation within” four years” according to Reuters. That shows a scary amount of complacency since low commodities prices could lead to low supply in the future. Specifically, the prices paid index was up 20 points to 57.7 and the prices received index was up from 30.2 to 42.4. We’re not making a grandiose call on inflation. We’re just reporting the numbers and saying some Fed members might be too sanguine in their projections for low inflation.

Are The Banks In Trouble?

As you can see from the chart below, the reserve build in commercial banking loan losses has been the quickest ever this year. The LC bank and consumer financial reserve ratio has spiked ever faster. Are the banks in trouble? They probably aren’t in trouble because mortgage loans will be fine since high quality loans were give out in the past expansion. This is nothing like the last cycle.

Obviously, lending in retail, hospitality, and energy is being hit the hardest. The banks have learned their lesson in energy which is why there are few giving out loans to this industry. This is, in turn, not allowing firms to boost supply. They probably wouldn’t boost supply at these prices anyway. However, they will also run into capital issues when oil prices rise which means supply won’t immediately increase when prices rise, making the increase more sustainable.

Whether the banks will face issues depends on the labor market. If the unemployment rate keeps falling, the banks will be fine. To be clear, we are only talking about loan losses. Profitability is about loan/deposit growth and net interest margins along with avoiding loan losses.

The Great Migration

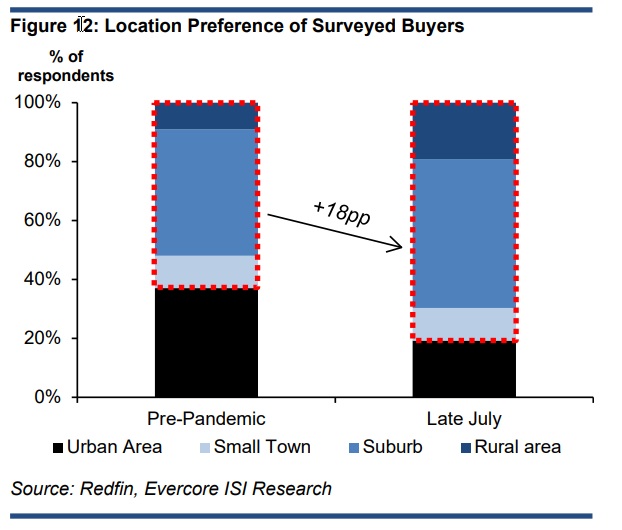

This spring we all were wondering if people actually were moving to the suburbs like some feared. We only had anecdotal evidence. Plus, we had basic logic that people might want to avoid COVID-19. It’s also notable that millennials are getting into their 30s which is when most people start families. Families are usually raised in the suburbs rather than the city because there is more space in the suburbs and it’s cheaper. That’s an additional layer that few discuss. This migration may have happened anyway. COVID-19 is just causing it to happen all at once.

We now have hard evidence that Americans are actually moving away from cities. As you can see from the chart above, the survey preference of home buyers shows there was an 18 point jump in those wanting to move to a rural area, the suburbs, or a small town from before the pandemic to late-July. There will probably be some reversion in this data once the pandemic is over.

The housing market is doing really well as MBA purchase applications growth in the week of September 18th was 25%. Furthermore, in July the FHFA home price index showed yearly growth rose from 5.8% to 6.5%. It’s highly likely that home price growth rose again in August and September given how low rates are and the decline in the unemployment rate.

Zooming To Infinity

Zoom Video is one great indicator for measuring sentiment on COVID-19. When the stock goes up, it could indicate investors think COVID-19 is going to last longer and have longer-term effects on how we work. From that perspective, the bad news is this stock is up 77.3% in the past month. As you can see from the table below, the PE ratio is 541 and the price to sales ratio is 92.7. Google’s highest price to sales ratio ever was 20 after it IPO’d in 2005.

Conclusion

The manufacturing sector rebounded in September. There are some inklings of inflation even though the Fed sees no chance of higher inflation anytime soon. The banks have had a quick jump in loan loss reserves, but the decline in the unemployment rate implies everything will likely be fine. The housing market is on fire; people are leaving cities for now. Tech stocks are a great measurement for how investors are thinking about the COVID-19 crisis and the future of work. Companies like Zoom Video have done so well, it’s worth near what ExxonMobil is worth. Many tech valuation metrics are like the ones seen in the 1990s tech bubble.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.