UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Both the Markit manufacturing PMI and the ISM manufacturing PMI had weak October readings, but they improved. When these indexes go from weak to okay, that’s a great signal for stocks. That’s why the industrials sector rallied 2.18% (on Friday) and is very close to its January 2018 record high. The graphic below shows that when the ISM PMI is below 50.7 and the prices paid index is below 53.9, stocks perform the best.

Historically, now is great time to buy stocks. The bearish counterpoint is stocks are up from when the downcycle started. Stocks fell in Q4 2018, but since then they have more than recovered. The problem for bearish investors is it’s tough to bet against the cycle based on a valuation call. If the manufacturing sector really did bottom, the probability is that stocks go higher even with tepid economic growth.

Markit Manufacturing PMI Hits 6 Month High

The Markit manufacturing PMI improved from 51.1 to 51.3 which is a 6 month high. Both the new orders and production indexes hit 6 month highs. The new orders index has increased for 5 straight months. The backlogs index ended its 3 month decline streak as it was flat. Manufactures had the most confidence on 1 year output growth since June. The increase in new orders caused pre-production inventories to fall at the quickest rate in 3 months.

The report stated that “Firms noted that their clients were exhibiting less hesitancy in placing orders and market conditions had improved.” The improved conditions were either cyclical or because of confidence about the potential trade deal. The comments section stated, “Tentative signs of renewed vigor are appearing in the US manufacturing sector, with the survey’s production gauge having now risen for three successive months to suggest that the soft patch bottomed out in July.” The recently bearish Markit report suggesting a bottom occurred is amazing news.

ISM PMI Improves Modestly

As anticipated by the regional Fed manufacturing reports, the ISM PMI improved. It went from 47.8 to 48.3 which is consistent with 1.6% GDP growth. It missed estimates for 49.3. It wasn’t a good reading, but it showed some green shoots. The new orders index rose 1.8 points to 49.1 which still signals a contraction. 5 of 18 industries had new orders increase.

The production index fell 1.1 to 46.2. Even with the GM strike, the employment reading increased 1.4 to 47.7. The export orders index rallied 9.4 points to 50.4 and the imports index fell from 48.1 to 45.3. The prices index fell 4.2 points to 45.5. Three of ten firms mentioned tariffs or the trade war in the comments section. A computer & electronic parts firm stated, “Customer demand is down, and we are expecting a very soft fourth quarter, without much relief in sight for Q1.”

Very Strong Jobs Report

The October jobs report was really strong. Fears of the slowdown ending the streak of positive job creation were way overblown. This report was strong because August job creation was revised from 168,000 to 219,000 and September job creation was revised from 136,000 to 180,000. That’s a 95,000 increase. Plus, job creation beat estimates in October. There were 128,000 jobs added which beat estimates for 90,000. This report was suppressed by the GM strike.

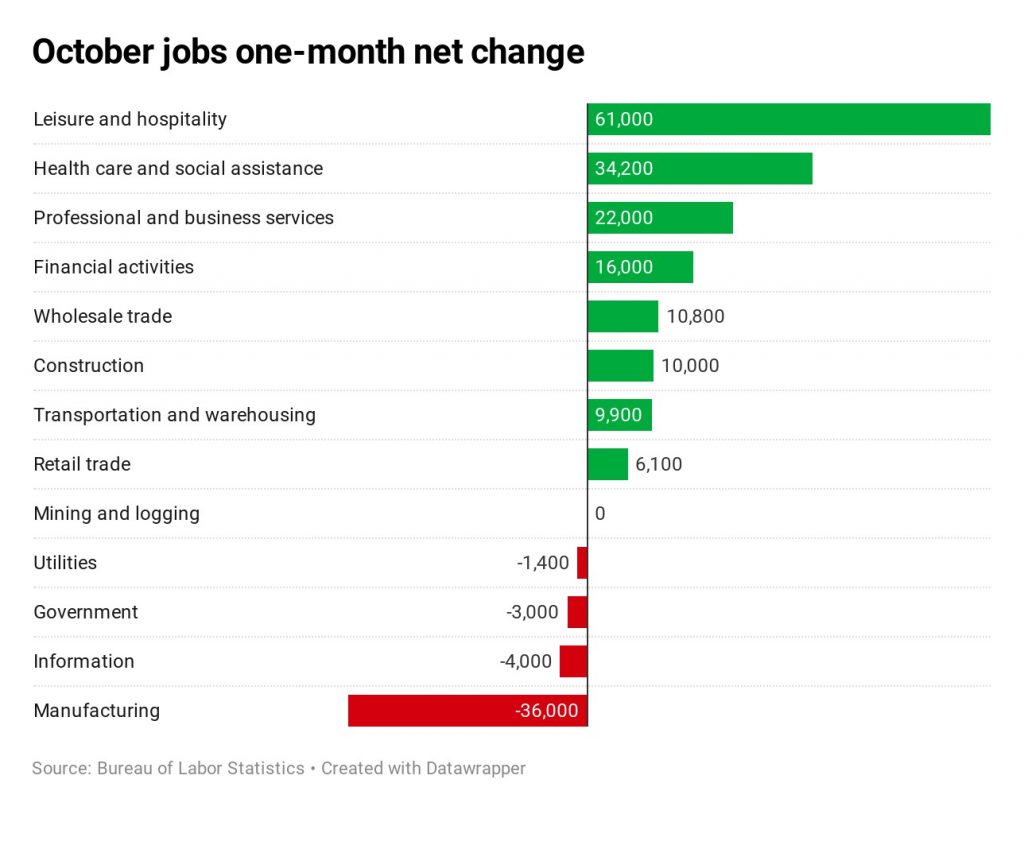

As you can see from the chart below, there were 36,000 jobs lost in manufacturing.

Job creation would have been 6,000 without the strike (which is over now). Overall job creation would have been 170,000. That’s 3 straight very strong readings. The most concerning aspect of this report is professional and business only added 22,000 jobs. This is where you see the cyclical weakness. The government lost 3,000 jobs which means private sector job creation beat estimates by 41,000.

Leisure & Hospitality Drives Job Growth

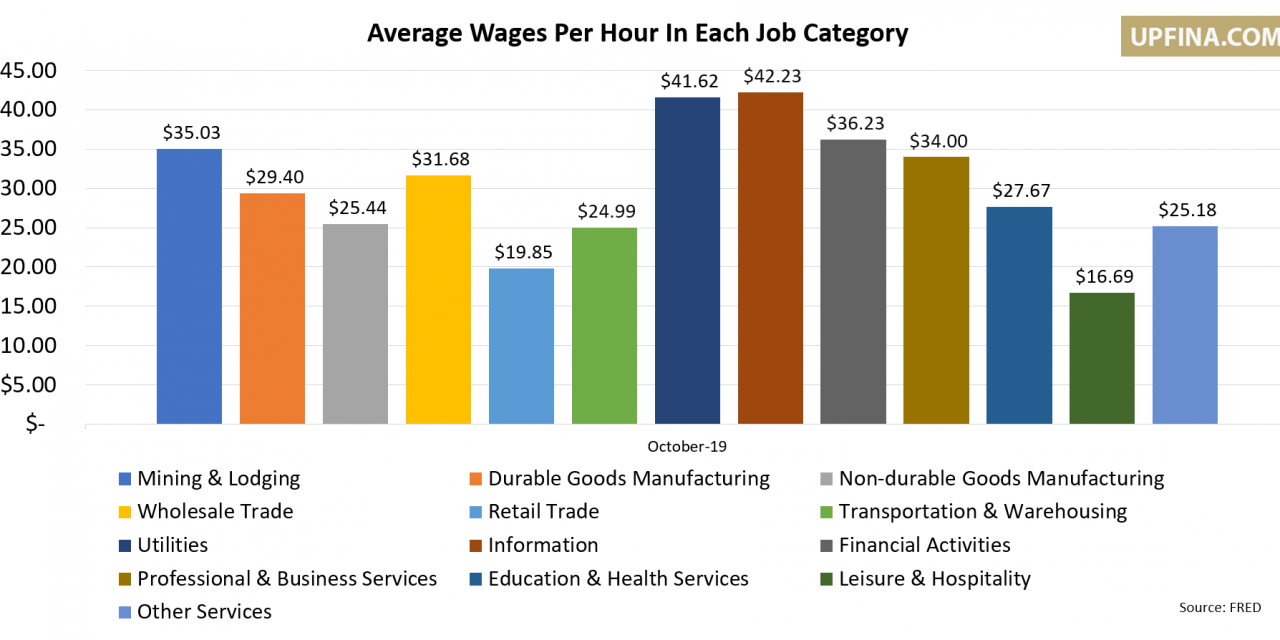

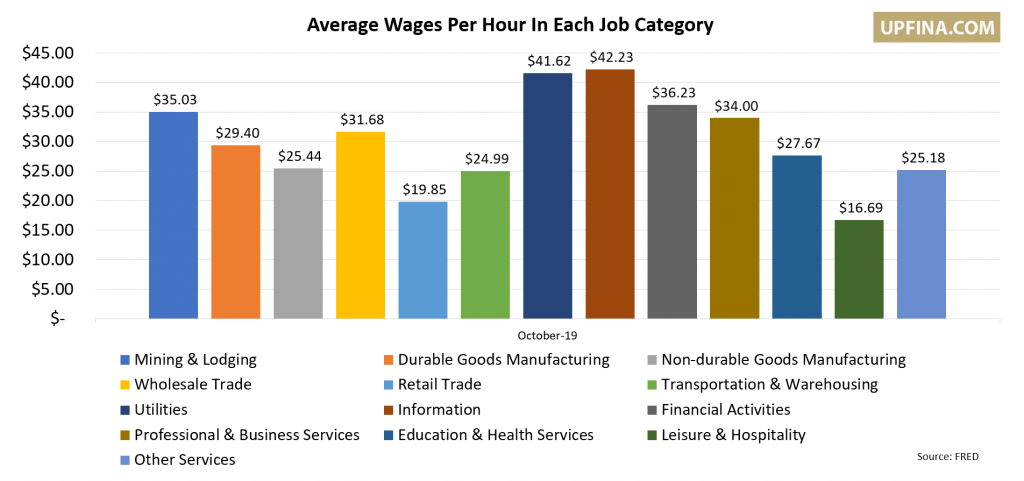

The biggest criticism of this report is it was boosted by leisure and hospitality which is the lowest paying industry. This industry was responsible for 46.6% of job creation in October. You can see in the chart below, leisure & hospitality jobs only pay $16.69 per hour. The all-important education and health services industry pays slightly less than the average of $28.18.

To be fair about the criticism of leisure and hospitality creating a high percentage of jobs in October, the percentage would have been less if it wasn’t for the GM strike. If there would have been 170,000 jobs created, the industry would have created 35.9% of the jobs. In the last 3 months, this industry has added 154,000 jobs. As you can see from the chart below, the 3 month annualized growth rate is 3.7%.

Level Of Job Creation Necessary To Maintain Unemployment Rate

The unemployment rate rose from 3.5% to 3.6%. The underemployment rate rose from 6.9% to 7%. As you can see from the chart below, at a labor force participation rate of 63.3%, job creation of 80,000 will maintain the unemployment rate. Job creation has been way above that in the past 3 months. The 3 month average is 176,000 (ex-GM it is 190,000). This implies there’s still some slack left in the labor market.

Maybe We Are At Full Employment

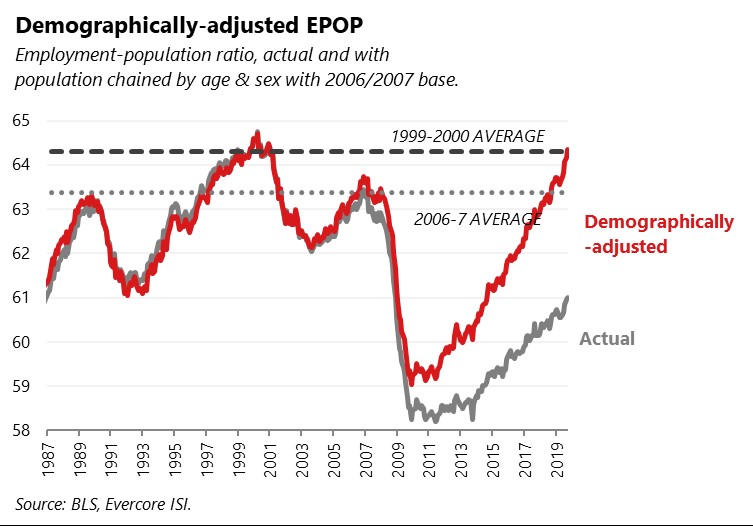

The labor force participation rose from 63.2% to 63.3% which beat estimates by 0.2%. That’s the highest rate since August 2013. The prime age labor force participation rate rose from 82.6% to 82.8% which is the highest rate since August 2009. This matches the expansion high. As you can see from the chart below, the demographically adjusted employment to population ratio has reached the 1999-2000 average. This implies the labor force is near full employment.

Strong Wage Growth

Average hourly wage growth in September was revised up 0.1% to 3%. October’s wage growth was the same as this revised reading. That’s actually a really nice improvement in the 2 year growth stack because growth improved sharply last October. The 2 year stack went from 5.98% to 6.36%. Weekly wage growth changed about the same because the length of the work week was steady at 34.4 hours. Average weekly wage growth was 2.74%. That’s off the cycle peak of 3.63%, but inflation is also down, so it’s not as much of a problem for real wage growth. The October CPI report comes out on November 13th. Low wage workers continue to have the highest wage growth as production and non-supervisory wage growth was 3.49%.

Conclusion

The manufacturing PMIs were weak and improved modestly. This could be the start of something great for stocks because when data goes from bad to okay, it’s a huge positive. Stocks do better when the ISM PMI is weak. The October jobs report was really good because of the positive revisions and the estimate beat. Job growth would have been even better without the GM strike. The biggest criticism of this report is too high of a percentage of job creation came from leisure and hospitality.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.