UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

On Friday, May retail sales in the control group and industrial production growth both beat estimates and both had positive revisions to their April readings which initially weren’t good. They support the stock market’s June rally and call into question any rate cuts that could be coming in July or September. This is why we follow trends instead of hanging our hat on monthly readings. Economic reports can be revised to show the opposite result of the initial reading.

April & May Retail Sales Growth

The retail sales update was like 2 reports in 1 because there was a major positive revision to April’s numbers and May’s growth in the control group beat estimates. It’s impressive for monthly growth to beat estimates when there’s a big positive revision to the previous month because that makes the monthly comparison tougher. Last month we described how April’s seasonal adjustment was very tough because of the Easter holiday shift, meaning the May reading could end up showing a rebound in growth. The seasonal adjustment didn’t change much with this update as both the non-seasonally adjusted and seasonally adjusted April sales results were revised higher by similar amounts. Therefore, we’ll just focus on the seasonally adjusted data.

It’s almost like a new month was added to the retail sales report as monthly growth in April went from -0.2% to 0.3%. Yearly growth improved from 3.1% to 3.7%. The next 3 data points are all monthly. Retail less autos sales growth was revised higher from 0.1% to 0.5%. Retail less autos and gas sales growth was pushed higher by 0.5% to 0.3%. Finally, the all-important control group’s growth rate was up from 0% to 0.4%.

Keep in mind, both of these reports affect Q2 GDP growth, so they are both very important. Moving on to May’s report, retail sales, retail sales less autos, retail sales less autos and gas, and the control group all had monthly growth of 0.5%. Headline retail sales growth missed estimates for 0.7% and the others beat estimates for 0.4%. Yearly headline growth fell to 3.2%. As you can see in the chart below, control group sales growth was steady at 3.4%.

These results aren’t near cycle highs, but they signal the slowdown isn’t that bad. This doesn’t necessarily mean there won’t be a recession soon as growth was 3.3% before the last recession. At least it’s likely the economy isn’t in a recession now.

Most of the underlying results in this report were very good. That explains how the chart below shows quarter over quarter retail sales and food services growth ex gas, building materials, and autos was the highest since 2008. To no one’s surprise, online sales growth was strong again as monthly growth was 1.4%. Yearly growth improved from 9.9% to 11.5%. Somewhat surprisingly, general merchandise sales were also strong as monthly growth was 0.7% and yearly growth was 3.3%. Both outperformed overall sales growth.

Restaurant sales growth was 0.7% monthly and 3.7% yearly. That monthly growth reading is great, but yearly growth fell from 5.5% because the yearly comp was very tough. The comp will only get tougher in June and July as yearly growth in those months last year was 6.3% and 9.6%. Growth is still far from where it was in 2017 when it troughed at 1.7% in September of that year. We remember some prognosticators calling for a recession based on that reading.

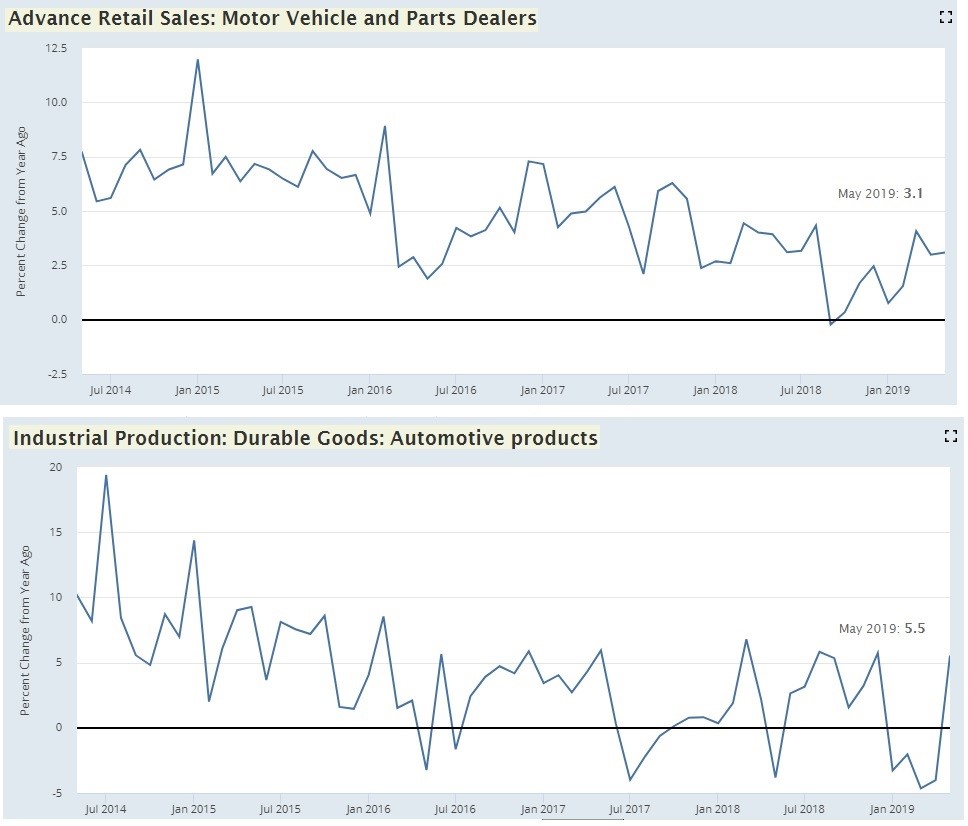

Auto sales growth was 0.7% monthly and 3.1% yearly. Some investors are now calling for a recession based on weak auto sales, but that’s likely premature. That’s near the low end of this cycle’s growth, but it’s far above the trough last September when growth fell to -0.2%. Growth will fall to negative in the next recession. Finally, gas station sales growth was 0.3% monthly and 3.2% yearly. That’s down from 5.6% yearly growth last month as gas prices have fallen.

Solid Industrial Production Rebound

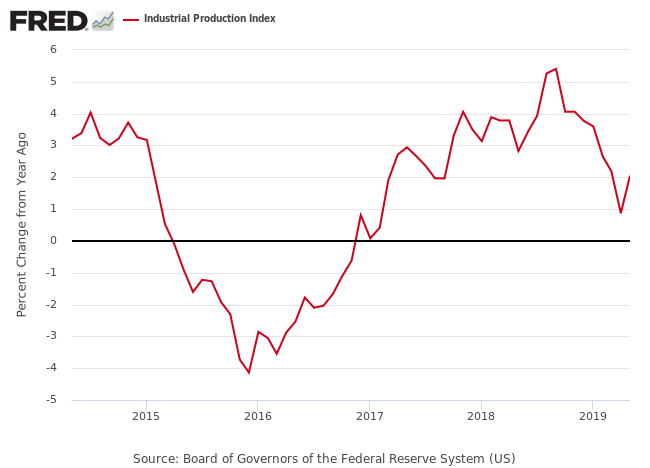

We mentioned last month that industrial production may have been weak in April because of a calendar quirk. Sure enough, growth rebounded as you can see in the chart below. Monthly production growth in April was revised from -0.5% to -0.4%. May’s growth was 0.4% which beat estimates for 0.2%. On a yearly basis, growth improved from 0.9% to 2%. While this is an industrial production slowdown, it’s not a recession yet. This is nowhere near the weakness of 2015 as yearly growth bottomed at -4.1% in December of that year.

Monthly manufacturing growth was 0.2% which met estimates. Yearly growth improved from -0.3% to 0.7%. That’s a big reversal as last month it looked like the manufacturing sector was headed towards a repeat of 2015. There was a 3.4% rise in automotive products production. This solid report is consistent with the good auto related news in the retail sales report. Yearly growth improved remarkably from -4% to 5.5%. Monthly hi-tech production growth was 0.4% and business equipment growth was 0.2%. Finally, utilities’ yearly growth improved from -4.8% to 0.2%.

GDP Nowcasts

These positive economic reports caused the CNBC median of 11 Q2 GDP growth estimates to increase from 1.7% to 1.9%. Similarly, the Atlanta Fed Q2 GDP Nowcast improved from 1.4% to 2.1%. That’s much higher than the blue chip consensus of 1.7%. The retail sales and industrial production reports caused the Atlanta Fed’s estimate for real personal consumption expenditures growth to improve from 3.2% to 3.9%. The St. Louis Fed Nowcast estimate is at 2.9%. If that growth rate is reached, the economic slowdown will have been limited to just Q1 (because of weak final sales growth).

The NY Fed Q2 Nowcast increased from its trough as it went from 1.01% to 1.36%. If growth comes in that low, fears of a recession will increase. The industrial production report increased the Nowcast by 0.21% and the retail sales report improved it by 0.1%. The Q3 Nowcast was also helped by this week’s data as it increased from 1.31% to 1.7%.

Conclusion

The negative April retail sales and industrial production reports are a wash. There were positive revisions and May’s reports were good. The likelihood of below 2% Q2 GDP growth diminished. The only potential bad news for the bulls is there is a chance the Fed looks at this data and decides not to guide for rate cuts this year.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.