UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

We’ve discussed the FAAMNG stocks mostly in a negative light in recent months because of the crowding effect. That’s when a business or industry becomes so loved that even if it does well, it’s unlikely to live up to expectations, causing it to have weak performance. The ‘old school’ theory is you need to believe something different from the market to make alpha. You can be bullish on a stock that has done well, but you need to be more bullish than expectations to make a profit above the market. You need to believe in something that isn’t priced in. You always need to be a contrarian in some matter even if it’s a popular stock. In reality, tech will continue to do well if real interest rates move lower.

That concept has gone by the wayside as some investors are piling in to the worst companies because their stocks have done the best. Let’s not forget how the growth trade started. It began with FAAMNG before morphing into unprofitable companies with strong momentum. The crowd is being led by retail traders using stock options to manipulate the underlying. Analysts fear career risk, so they just go with the hot trades, acting like short term speculators who only care about stock prices. At least the FAAMNG stocks have had amazing business performances. As you can see from the chart above, FAAMNG is in a league of its own in terms of high asset growth combined with a high return on equity. No other industries come close to matching this performance.

Staples Never Lose

As we mentioned, in this market investors have piled into the worst businesses. Anything with sales growth wins even if there is no chance of making a profit. In fact, if competitors all don’t need to make a profit, then it will be tough to ever turn one because competition will be brutal. In the late 1990s and today, it’s better to lose money so investors can be as optimistic as possible. Once real profits start, investors are stuck projecting growth more realistically. This market is perfect for tech stocks and IPOs/SPACs.

This isn’t a great market for staples, although, the ones that benefit from COVID-19 did well in the spring and the summer. In general, staples is a boring sector which is why it has done so well historically. It’s tough to create a new food brand or a new personal care product line. These are low growing industries with well-established players with amazing brand recognition. There isn’t much disruption.

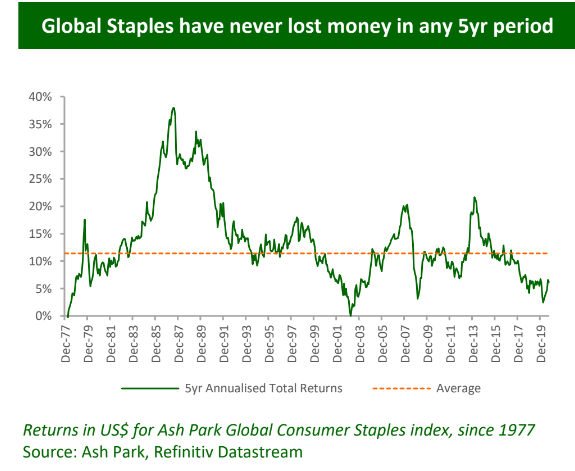

Within food, the imitation meat firms act as disruptors, but they have such small market share. It’s extremely difficult to reinvent food. That’s why 5 year annualized returns of consumer staples, as shown in the chart above, have never been negative. That’s great for two reasons. There is less likely to be a bubble which means you don’t need to worry you are buying at a top. Secondly, you won’t ever be forced to sell because of high valuations.

Boomers Own A Ton Of Stock

This has been a K shaped recovery as almost everyone who owns assets such as houses and stocks has won big. Those who don’t own stocks are in trouble as they probably can’t work from home and they rent. As of Q2, the top 1% owned 52.4% of corporate equities and mutual fund shares. The bottom 50% owned only 0.6% of stock with most not owning any. Part of this is older people owning stocks as rich people tend to be older. $32 trillion in stock or 74% of the market is owned by people over the age of 55. As you can see from the chart below, 28% of U.S. equities in 2019 were owned by those over 70.

Firstly, there’s a risk Boomers own too much stock for their age group. They might be taking too much risk. If they all start to sell at once, it could be like a waterfall. So far, we have seen low rates help keep people in stocks longer than they may have otherwise been in them. Plus, stocks have done very well (recency bias). The March crash scared people, but it wasn’t elongated. It wasn’t like the typical bear market that discourages stock ownership for years.

This year Millennials entered the market in much greater numbers. Some thought many Millennials would either never enter stocks or that they would stick with index funds. Everything changed in 2020 when picking stocks became ‘easy.’ This won’t last. The transfer of equity ownership to Millennials might not continue to go so smoothly. Every generation gets scared out of the market.

Extremely Euphoric Market

We are in a very hot market. The MSCI ACWI, Russell 2000, and value stocks all had their best month ever in November. The Dow had its best month since January 1987. Most traders haven’t ever seen a moment like this before. You don’t need to be old to learn from history. Read about prior bubbles especially in the late 1990s. That will help you in 2021.

Obviously, fund managers are euphoric too. As you can see from the chart below, the NAAIM fund manager exposure index rose from 106.41 to 106.74 which is a new 2020 high.

The peak in August was 106.56. The big difference between this market and August is this one is being driven by value stocks. In late August, growth stocks were the hottest.

Conclusion

The FAAMNG stocks, which began this run for growth stocks, are amazing businesses in terms of asset growth and return on equity. The rally in growth stocks has morphed to a rally in the worst businesses. This isn’t a market for boring staples. Consumer staples isn’t an exciting sector which is a feature not a bug. They don’t get so expensive that they can’t have positive returns in the next 5 years. Older people still own a lot of stock. In 2020, Millennials got involved. This will be a learning experience for new speculators, meaning they will lose money. The average fund manager is leveraged long stocks as this is a overhyped market just like in late August except now value is leading instead of growth.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.