UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Even with the big spike in COVID-19 cases in the Midwest and fears of a slowdown, the jobless claims report in the week of October 24th was good again. Make no mistake about this, if COVID-19 was causing weakness, we would have seen it by then. There have been two good reports in a row now. Seasonally adjusted initial claims fell from 791,000 to 751,000 which was below estimates for 758,000 and 1,000 above the low end of the consensus range.

Non-seasonally adjusted claims fell from 761,000 to 732,000 which is 1,000 above the cycle trough 3 weeks ago. COVID-19 might not have caused a spike in initial claims because the industries that are hurt the most by COVID-19 aren’t going to shed many new jobs. They already cut jobs and shuttered. It’s not like leisure and hospitality recovered and is stuttering again. It is still in a world of hurt. This latest COVID-19 outbreak just means the recovery will take longer to play out. Their financials will be stretched further. If the economy reopens next year, we will see initial claims go back to normal levels seen in prior expansions.

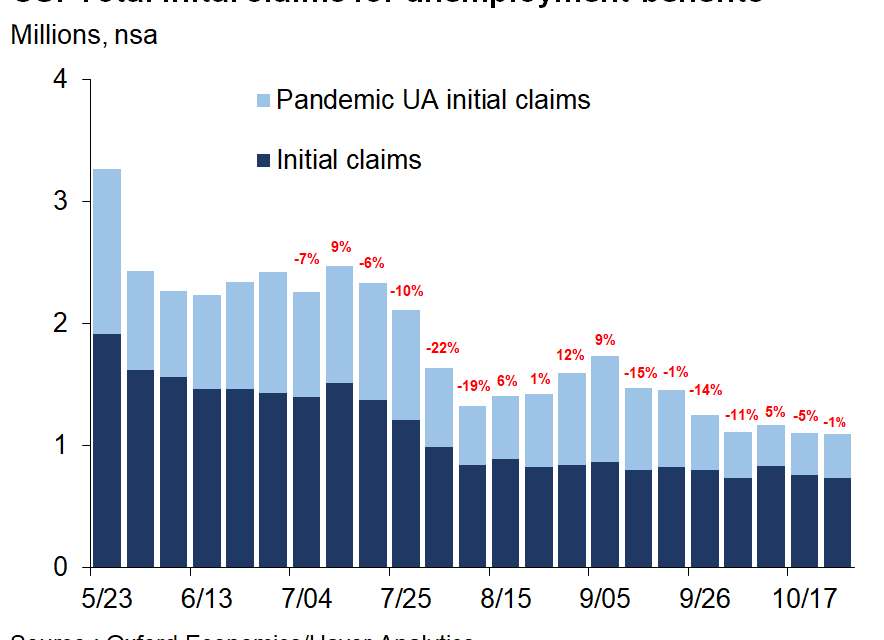

As you can see from the chart above, the combination of PUAs and initial claims fell 1% which was the 6th decline in 7 weeks. PUA claims were up 15,000 to 360,000. PUAs don’t matter on a week to week basis because the data is inaccurate. It probably wasn’t accurate this week as PUAs in Nevada were up 45,000 to 58,000. Without that ridiculously large increase, national PUAs fell. The mistakes stick out like a sore thumb.

Continued Claims Fall More Than PEUCs Rise

In the week of October 17th, continued claims fell from 8.465 million to 7.756 million. That was the smallest decline since the week of September 12th. However, we are closing in on the May 2009 high of 6.635 million (excluding pandemic claims). The rate of decline in continued claims should fall in the next few weeks because there is less room for claims to fall and because we are ending the period where the main swath of job losers’ benefits will expire. October is 6 months from April which is when initial claims were very high. There weren’t as many job losers in May as April, so fewer people will lose benefits in November.

The coming negative catalyst is pandemic unemployment claims stop paying out at the end of the year. The government should extend them no matter who wins the election, but if they don’t, we could have a sharp slowdown. There are currently 3.68 million people on PEUCs. There is no way a vaccine comes in time to get these people jobs by the time their benefits expire. Even if a vaccine is ready by the end of the year, it will only be given to the most vulnerable which wouldn’t be enough to reopen the economy and get people their jobs back. It will take until next spring at the earliest to fully reopen the economy.

In the week of October 10th, there was a 387,000 increase in PEUCs which was an improvement. There was a 510,000 increase in PEUCs the week before and an 823,000 increase the week before that. Remember, we want smaller increases as these are benefits programs. In the week of October 10th, non-seasonally adjusted continued claims fell 926,000 which means they fell more than PUECs increased. Remember, continued claims data is delayed by 1 week and pandemic claims data is delayed by 2 weeks.

A greater decline in continued claims than an increase in PEUCs means labor market continued to heal as the chart above shows. Obviously, we don’t want people to only focus on the decline in continued claims, but at this point, everyone knows there are pandemic benefits. No one actually thinks the labor market is close to normal. We are only closing in on the worst of the financial crisis (the worst recession since the Great Depression).

Many Investors Admit To Anchoring Bias

As you can see from the poll below, we asked our followers if they researched a stock, but then shelved it only to see it double a couple years later, would they have the will to buy it at the higher price?

It’s best to be honest with yourself because this is an anonymous poll and it only hurts your own investing if you lie to yourself. About half of people said they wouldn’t be able to admit they were wrong for not buying it originally and buy it back at the higher price. This is working under the assumption that you like the stock at the higher price. Just because a stock doubles doesn’t make it more expensive.

Investors who can’t buy a stock they started following at lower price are exhibiting anchoring bias. They are biased to the first piece of information they saw. They want to buy it at the price they started following it at. It feels like it got away if you buy after a double. However, you can’t compound the mistake by avoiding the winning stock again. Now that you know this, you should work to combat this bias and the other three listed in the graphic above. Confirmation bias is the worst of all. Traders try to use every new piece of information to support their thesis even if it doesn’t support it.

Conclusion

It’s surprising to see two straight good jobless claims reports. The labor market isn’t out of the woods, but this is better than you’d expect with the huge rise in COVID-19 cases. About half of our followers admitted in our poll that they suffer from anchoring bias. Everyone suffers from all the biases listed before they correct their bad habits. That’s why you need to recognize them now. Be honest with yourself and think about if you can correct mental errors. Don’t think you are above making mistakes because you aren’t!

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.