UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

It’s possible inflation spikes in 2021 due to a return to normalcy and a fiscal stimulus. That sounds unlikely now, but imagine a world where demand for goods and services increases and the leisure and hospitality industry fully reopens. That largely depends on the solutions to COVID-19 and the size of the stimulus. Economists believe the biggest stimulus will occur if the Democrats win the Senate and the Presidency. The chart below shows the potential paths PCE inflation can take if there is no stimulus, a base case stimulus (the $1.8 trillion deal the GOP proposed), and a Biden stimulus. Currently, inflation is being suppressed by rent costs. That will turnaround if COVID-19 is under control.

The COVID-19 situation has been getting worse in the past few weeks because of the Midwest. Specifically, Wisconsin had the 3rd most new cases in the country on Wednesday which is a big deal because it is the 20th largest state by population. The 7 day average of new cases in the state spiked to 2,840 which is a new high as case counts have gone vertical. It’s possible the Midwest is seeing a wave of cases because it never had a big one yet.

It seems like each area that hasn’t seen a spike in cases eventually has one. There has been a modest increase in cases in the other regions, but that’s likely because of higher testing. The 7 day average of testing reached 1.021 million which was a new high. The bad news is there were 37,046 people in the hospital which is over 7,000 more than the trough in September. The good news is the 7 day average of new deaths fell to just 685.

Earnings Season Is Here

Q3 earnings season has just started. It comes at a time when COVID-19 cases are rising and the election is in focus. Plus, we have the uncertainty of the stimulus. Earnings season is a reminder to cut out the noise. Don’t focus on anything that won’t impact earnings (not saying the previous things mentioned are noise). It’s also a reminder of how expensive some software stocks have gotten. Pricing stocks based on future sales and euphoric profit expectations isn’t a good idea. That explains how the CLOU cloud index is up 62% year to date.

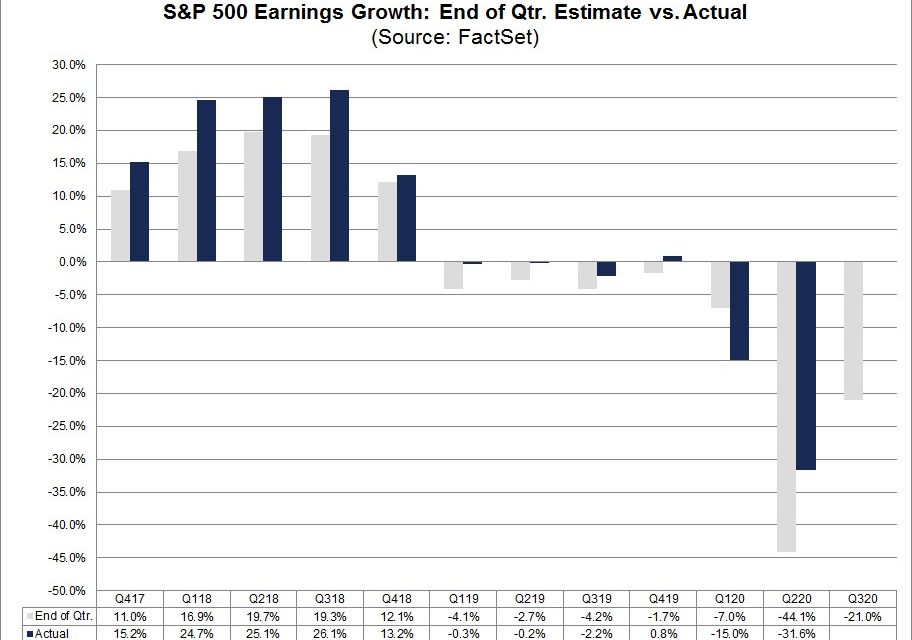

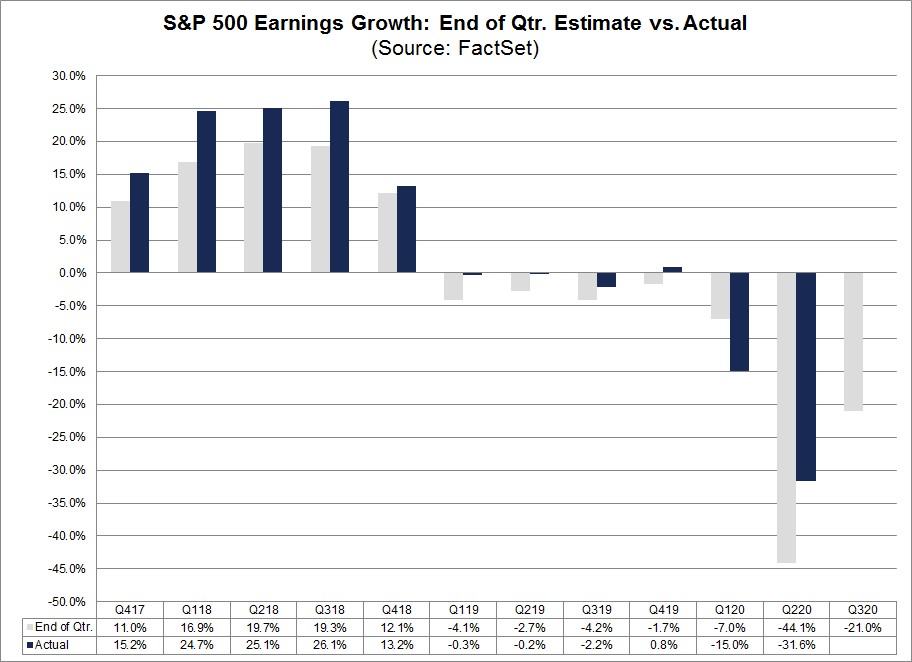

The obvious aspect of earnings season many first level thinkers will focus on is how well stocks have done compared to actual results. As you can see from the chart above, EPS estimates ended the quarter at -21% growth. Even if estimates are wildly beaten, there will still be a sharp decline with the stock market near its record high. However, that doesn’t mean the stock market is due for a crash. For one thing, the sectors with the worst earnings have done the worst and the sectors with the best earnings have outperformed.

Healthcare’s earnings are expected to fall just 40 basis points, while energy’s earnings are expected to fall 118.4%. That’s right, they will fall more than 100% because there will be losses. Remember, 2019 wasn’t a great year for energy as it underperformed the overall index. This year will go down as one of the worst ever for the sector. Some might wonder why anyone would buy energy if profits are down so much. The answer is expectations for a cyclical upswing. The goal is to buy when the industry is hurting the most because lower production leads to higher prices.

Strong Guidance

Stocks are up even though earnings aren’t because traders jumped the gun on the recovery. This trade was a little different from normal though as we have seen the value stocks underperform at a time where they usually do well (early in the cycle). That’s because this isn’t a true recovery. Yes, job creation jumped more than ever. However, in this new economy, many of the old businesses can’t survive/thrive because of social distancing.

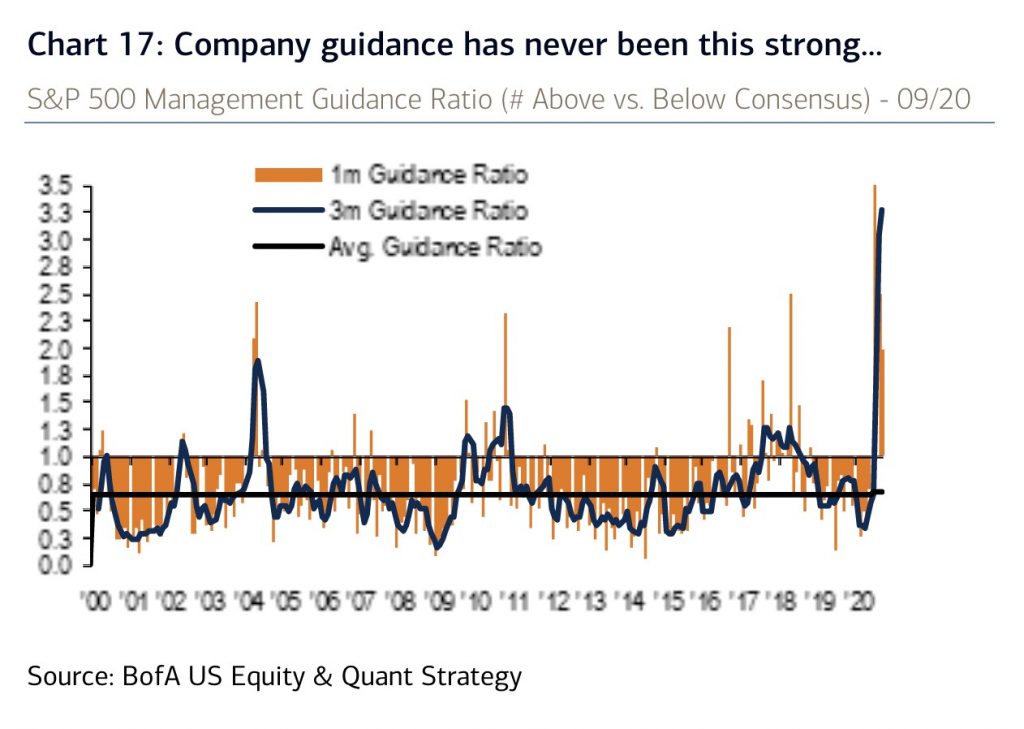

This might be a good earnings season as the economy recovered quicker than expected, at least for large cap companies. It’s not the same for independent leisure and hospitality companies of course. As you can see from the chart above, the 1 month guidance ratio hit a record high before falling. With 2 strongly positive months, the 3 month average is now at a record high. We will be following the rate of change of Q4 EPS estimates which will be impacted by guidance.

We will also track the number of firms who give full year EPS guidance. In Q2, 147 firms withdrew guidance and 138 gave it. The good news is most of the withdrawals are likely done. As you can see from the chart above, 37 firms gave guidance after withdrawing it and just 3 withdrew it after giving it in Q1. We’re not saying uncertainty is gone. It’s just that there isn’t more uncertainty than there was 3 months ago. Every week we get more data on COVID-19, whether it’s deaths, cases, testing, vaccines, or therapeutics.

The smartest thing to do is to give various scenarios to help investors. A firm can say it sees this number of sales if a COVID-19 is contained and this number if it isn’t. The firm can also give guidance with and without a stimulus. It can detail those results or just give a wider than normal range. Obviously, if the range is too wide, it becomes meaningless. Also, you don’t want to focus on the middle of the range because that’s probably the least likely result. Normally, investors focus on the midpoint, but in this case it’s an either-or scenario.

Conclusion

Inflation could rise meaningfully in 2021 if COVID-19 is under control and the Biden fiscal stimulus is large. Q3 earnings season is here. Even if the results beat estimates by a wide margin, we are still looking at a greater than 15% decline from last year. That being said, guidance has been strong and more firms will be giving it. Don’t harp on overall growth because there are 2 markets. There are the industries that benefit from the new economy and those that don’t. Invest in the value cyclicals if you see a recovery next year with less COVID-19 and a stimulus. Software could maintain its gains if the status quo remains.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.