UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

Price has a massive impact on sentiment. People begin to believe things that they otherwise wouldn’t have when prices were lower. From 2001 to 2019, most investors said the late 1990s was a crazy moment in market history which they probably wouldn’t participate in if it happened again. Now, we are seeing the late 1990s used as justification for current valuations. Furthermore, investors are supporting their current optimism by saying 1990s traders were right because the internet ended up being a massive thing which transformed society forever.

Some Future Industries Don’t Last

Of course, it’s not that simple. Many of the expensive internet companies that were successful had their stocks languish for years until they recovered. The unsuccessful ones never recovered. Then there was the hype around telecom which had terrible unit economics and was a major flub. The graphic below is from Tren Griffin’s article.

As you can see CELCs didn’t work so they ended up going away. This could end up being a preview to fuel cell technology which is in its infancy. That’s a nice way of saying the energy is uneconomical unless there is massive help from the government.

Growth areas like genomics, electric vehicles, and sustainable meat are seen as long term trends that can’t be stopped similar to the internet in the late 1990s. Speculators have tunnel vision; they see the success of the internet and think they can survive any volatility because they survived the volatility in March. The decline in March was a few weeks where there was an instant snapback. The bear market in the early 2000s was a couple years and much deeper.

More importantly it was a secular shift away from growth stocks and towards value stocks. This entire year has just been an extension of the trend in the past few years where anything with growth does well. New growth investors have no idea what it would be like if markets shifted towards value. Growth bulls can’t even see why someone would want to invest in what they see as dying industries (banks & fossil fuels). However, it’s possible some of the trends they see as inevitable aren’t.

We mentioned three vastly distinct growth areas to show there’s a potential for some to go right and some to go wrong. When these stocks fall, some holes will be poked in the theses of the growth trends. These new arguments will sound good and potentially push new traders along with the negative sentiment, selling after losses.

Cheap Versus Expensive

There haven’t been many worse areas in the market than value tech. In theory, this makes sense because tech is all about innovation and many value stocks aren’t on the cutting edge of industries. However, for many years Microsoft was considered a dead value stock that had no hope despite its solid profit growth in that period. Perceptions are hugely impacted by price which is why you need to do your own research and come to independent objective conclusions.

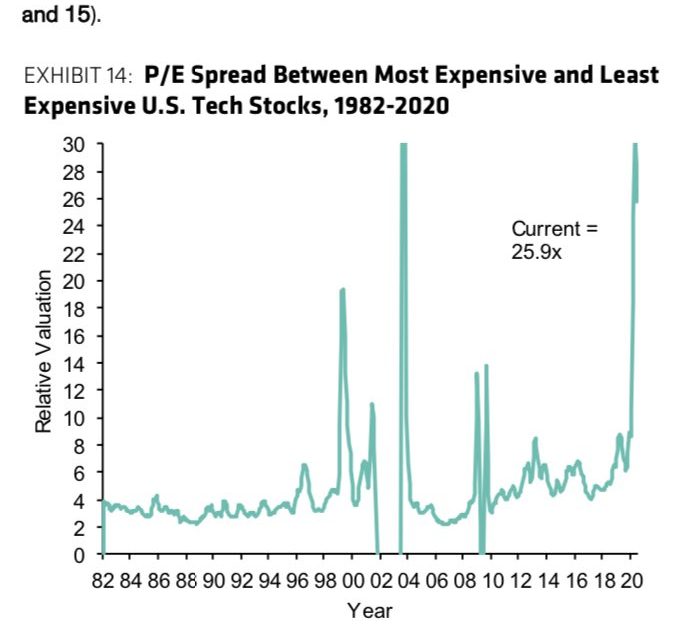

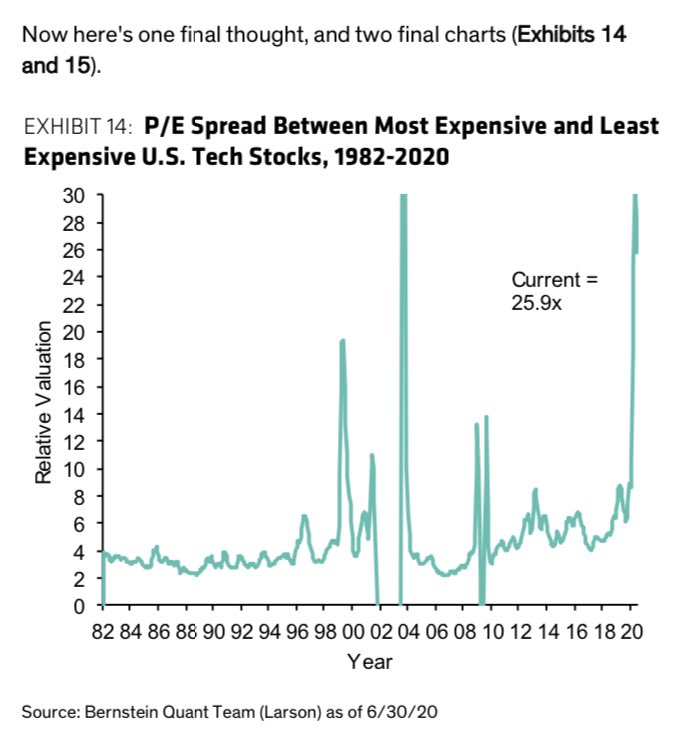

We showed in a previous article that as the tech bubble burst, the equal weight index beat out the market cap weighted index. The names that were cast aside didn’t fall as much. As you can see from the chart above, in 1999 there was a massive spread between the most expensive and the least expensive tech stocks. That difference peaked at an even higher level this year. It’s oversimplistic to just buy the cheaper tech stocks, but that’s a good start. Furthermore, it’s also simplistic to avoid all tech just because there is high speculation in certain names.

Very High Valuations

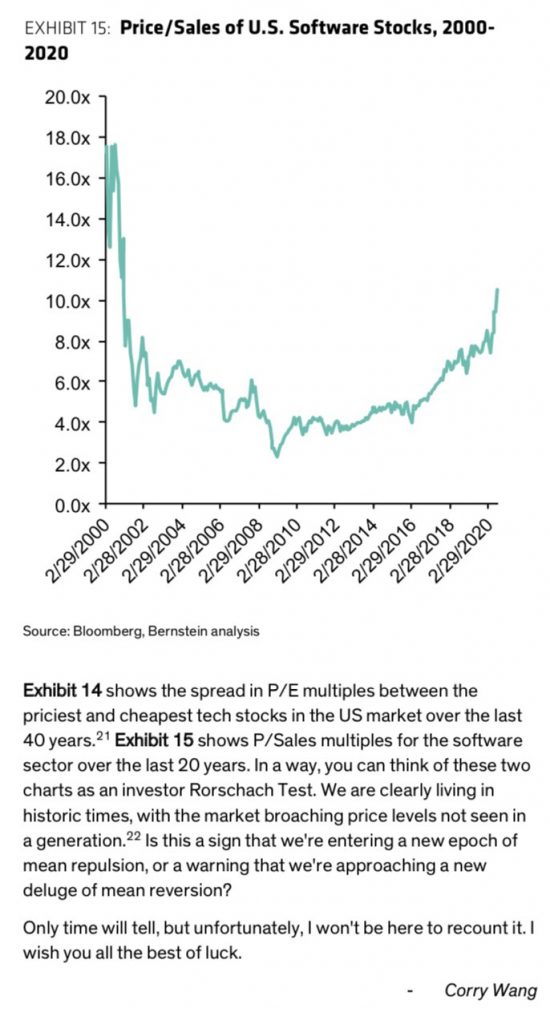

As you can see from the chart below, as of the end of June the price to sales ratio of software stocks was the highest since the tech bubble, but still about 6 points below the peak. Obviously, tech stocks have continued to rally since then. From June 30th, to December 24th, the WisdomTree Cloud Computing ETF was up 43.74%. We have even more expensive software stocks now.

The two theses that are propelling these stocks are the ‘digital transformation’ and recurring revenues. In fact, plenty of companies outside of SaaS are getting expensive multiples because of their recurring revenues. They are viewed as a treasury replacement. This is a pretty bad deal because at such high valuations, you will get low returns. If the revenues really aren’t a lock as the market expects, there will be a terrible re-rating. ‘Digital transformations’ are very important, but with such high valuations, competition is coming for these software stocks. That’s great for end users, but not for providers.

Growth Hiccup Bad News

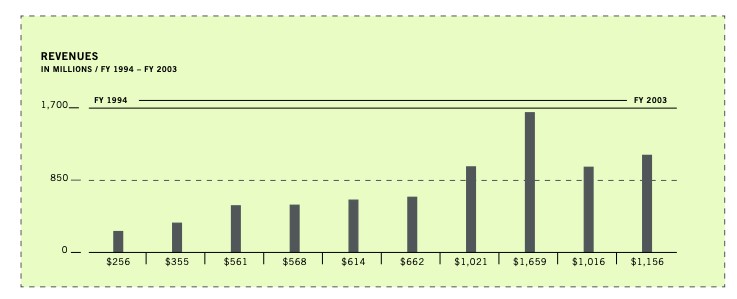

When a stock has a high multiple, temporary weakness can cause a massive crash in the stock. Panic sellers will claim the business is tainted even if it isn’t. Quite frankly, almost every business has a bad year at some point. We’d rather not own a stock that can fall over 80% due to a bad year because bad years are unpredictable. The chart below shows Xilinx’s temporary drop in revenues. Xilinx stock fell 85.4% from its peak in 2000 to its trough in 2002.

Declining sales growth is the death knell for high multiple software stocks. Competition will eventually eat them alive even if they have recurring businesses. As you can see from the chart below, the median SaaS company gross profit growth has fallen from 50% in 2016 to the high 20s (the last quarters in the chart should be 2020 not 2021). Competition and tough comparisons have already gotten to the software industry. Let’s see when speculators figure this out.

Conclusion

Speculative investors are hopped up on the price action. They are like gamblers at the casino as they are long cloud stocks on margin because they are the future. We’ve seen this play out before in the late 1990s when telecom and tech stocks were sent to the moon before crashing. The future is tough to predict. Not all these trends will go as planned. Even the successful tech firm, Xilinx, suffered a nasty 85% crash in early 2000’s because of temporary sales weakness. The median gross profit growth rate of SaaS stocks has already been falling. It’s not a good idea to act as if recurring revenues are a guarantee. These stocks should not be treasury replacements.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.