UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

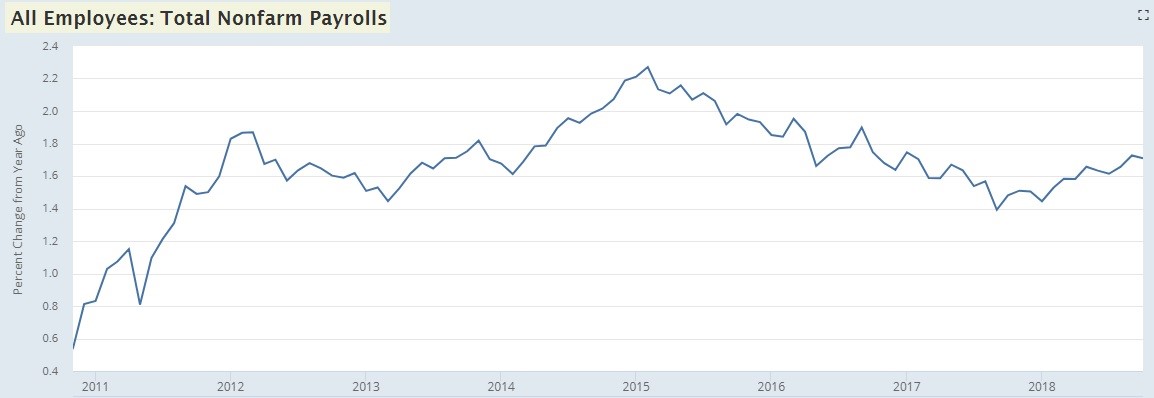

The declining job creation growth from 2015-2017 on a year over year basis caused fear because it implies the labor market cycle is nearing its end. However, those fears have been abated in 2018. The October report showed 250,000 jobs added which beat estimates for 190,000. The September report was revised down from 134,000 to 118,000, but that weakness was catalyzed by the hurricane. The August report was revised up from 270,000 to 286,000, meaning 2 of the past 3 reports have been very good. Sometimes great reports are tainted by negative revisions, but in this case, there was no net change in the past 2 reports combined which is a great sign.

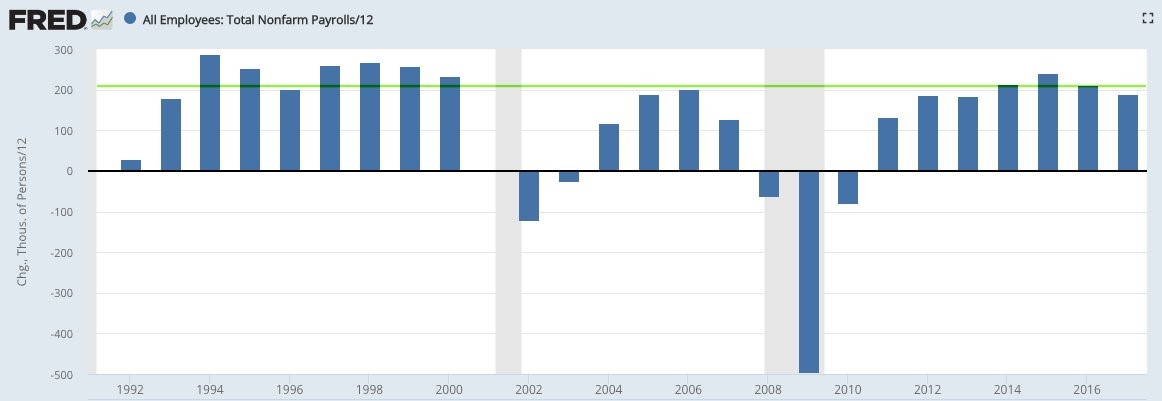

The unemployment rate was steady at 3.7% and the underemployment rate fell from 7.5% to 7.4%. The previous cycle troughed at 7.9% and the 1990s cycle troughed at 6.8%, putting the current level right in between the two. There has been an average of 212,500 jobs created in 2018. If that is steady for the rest of the year, it will be the 3rd best year of job creation since 2000 as you can see from the chart below. This indicates that the labor market still has slack, since by growing faster than population growth it means people are coming off the sidelines.

Terrible For Stocks & Bonds

Even though this labor report is great for workers since there was good job creation and solid wage growth, this was bad for the stock and bond market because it signals labor costs will increase and inflation might increase. Margins will be hurt by wage growth and the Fed might need to hike rates to keep down inflation. As a result of this report, the 10 year yield increased 8 basis points to 3.21% and the S&P 500 fell 0.63%.

Wage Growth Explodes

Let’s look at wage growth specifically now. Average hourly earnings growth was 0.2% month over month and 3.1% year over year. Year over year growth spiked from 2.8% in the previous month, beating estimates for 3%. It’s best to look at weekly wage growth to measure take home pay as the amount people work shifts. The work week was steady at 34.5 hours. Average weekly earnings growth was 3.4% which marginally beat the previous cycle peak in October 2010. This growth is far more consequential because more workers are employed now. This is the highest weekly earnings growth since August 2007.

We have been discussing the possibility of stronger real wage growth in previous articles. This seems to be occurring. We only have the inflation reports from September, so we aren’t sure about October yet, but the results look promising. Headline CPI growth fell from 2.7% to 2.3%. Since oil fell in October, it’s possible headline CPI was weak again in October. That would go great with the 3.4% nominal weekly wage growth.

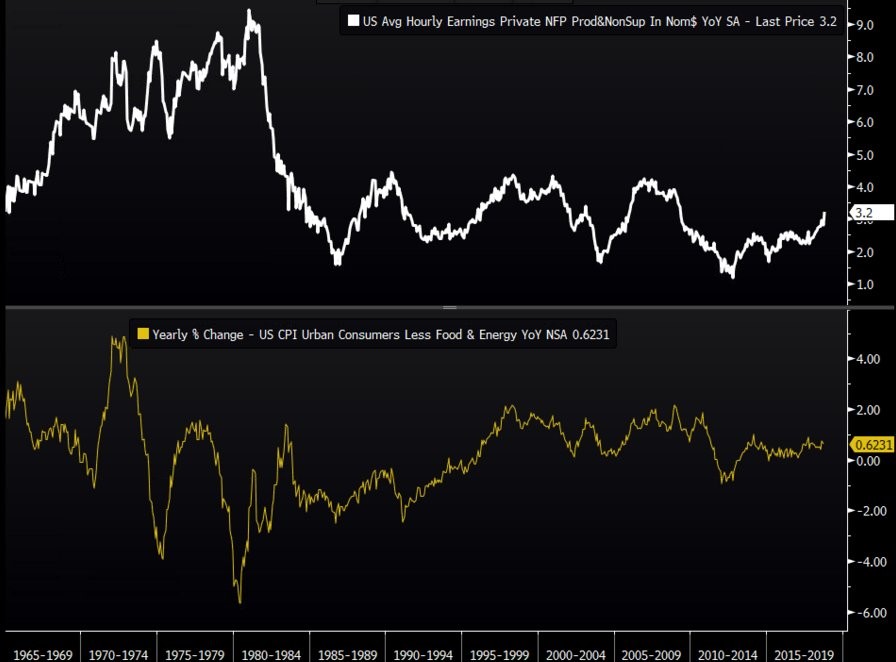

The chart below looks at production non-supervisory wage growth and core CPI.

This chart shows real wage growth is 0.62%. In the 1970s it was 56 basis points, in the 1980s it was -159 basis points, in the 1990s it was 2 basis points, in the 2000s it was 111 basis points, and in the 2010s it has been 39 basis points. That puts this decade in 3rd place out of 5.

Decent Productivity Growth

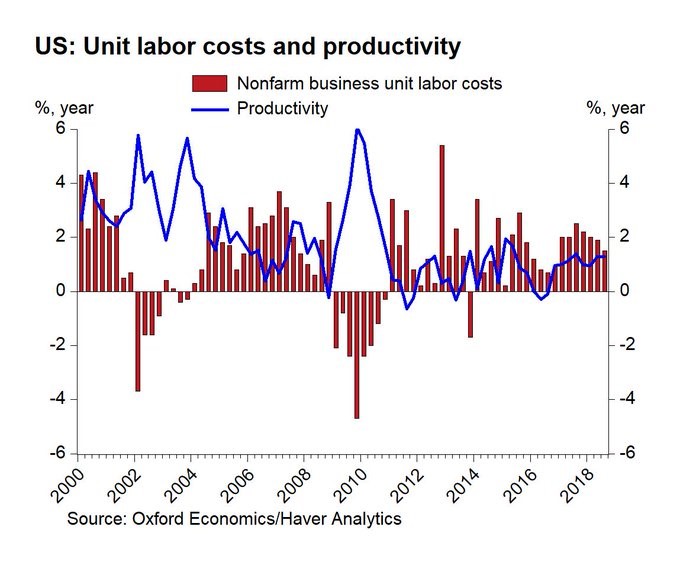

The BLS report isn’t the only way to measure wage inflation. The Q3 productivity and costs report showed unit labor costs were up 1.2% quarter over quarter and productivity growth was 2.2%.

Unit labor costs fell 1% in Q2 and productivity growth was 3%. Compensation was up 3.5% in Q3 which increased from 1.9%. Output growth slowed from 5% to 4.1%, but that’s still a strong result. Hours worked growth slowed from 2% to 1.8%. Real compensation growth was 1.4% which was up from negligible and negative growth in the past few quarters. This was a great report as there was strong wage growth and strong output growth despite limited growth in hours worked.

Participation Rate Increases

The labor participation rate increased from 62.7% to 62.9% which beat estimates for 62.8%. This isn’t the best measurement because demographics naturally suppress it. It’s best to look at the prime age participation rate. This rate increased from 81.8% to 82.3% which is the highest rate since April 2010 when it was still declining. In theory, the rate could reach the previous cycle peak of 83.4% in just over 2 months if it keeps increasing at the current rate, but we’ve seen increases followed by declines in the past few years making that unlikely. It will likely increase slower than that.

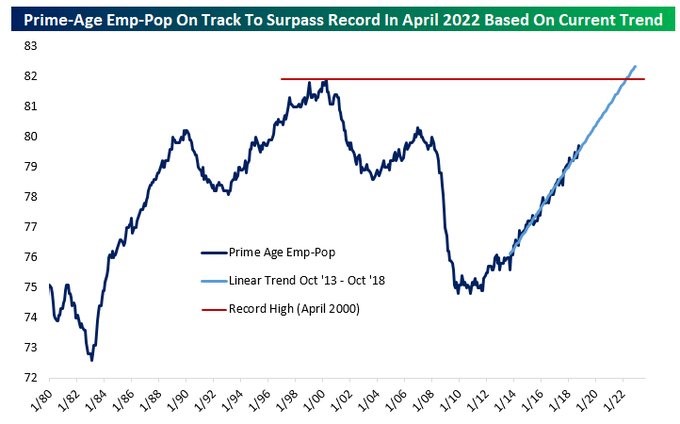

The chart below aims to time the point where the labor market becomes full and peaks.

Based on the current trend, the prime age employment to population ratio will reach the April 2000 all-time peak in April 2022. That’s probably the latest this cycle will peak. If it peaks at the 2007 peak or the 1990 peak, the cycle will end much sooner.

Too Many College Grads?

The interesting part of measuring the fullness of the labor market is that the least educated people have more jobs than ever, but the educated people still haven’t fully recovered. The employment to population rate for those without a high school diploma is 44.9% which is the highest on record. The employment to population rate of those with a college degree is 64.2% which is about a 1% recovery from the cycle trough. That’s not enough to recover from the 5.5% decline caused by the recession.

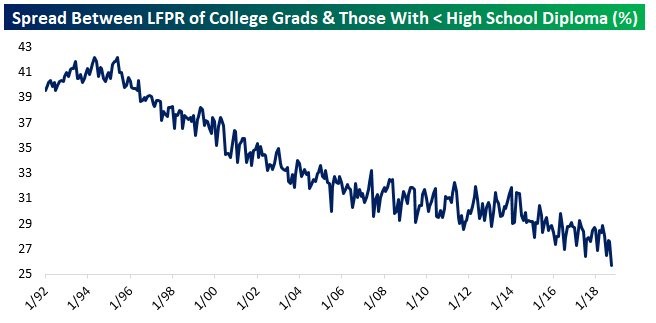

As you can see from the chart below, the labor force participation rate spread between those with a college degree and those with less than a high school diploma is cratering.

That’s because the education rate is increasing faster than the amount of jobs for uneducated people is declining. The education rate is increasing faster than the job creation for educated workers, showing that there is increased supply of educated works in the labor market.

Straight To A Job

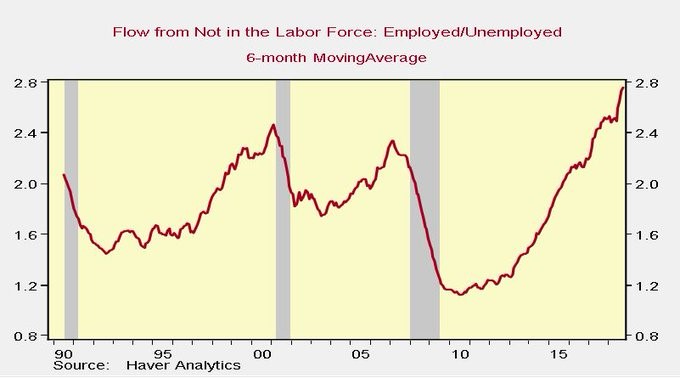

The chart below is an interesting new way of looking at the labor market.

The chart shows the flow of people going directly to a job versus joining the ranks of the unemployed is at a record high. The demand for labor compared to the supply is at least the best since 1990.

Conclusion

The labor market is tightening, but probably has a few quarters left before it is completely full. The problem for the stock market is wage growth is going to keep coming which will reduce margins. Furthermore, the Fed will be raising rates to combat this. The Fed is expected to raise rates one more time in 2018 and two more times in 2019. It takes 4 more hikes for the Fed to get above the long run rate. However, the Fed could also raise the long run expected rate.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.