UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

As we mentioned in a previous article, there was some contention over the unemployment rate. On the one hand, it should have been 3 points higher. On the other hand, the size of the miscalculation fell which means the unemployment rate fell more than the headline numbers indicate. It’s in the eye of the beholder which tale they want to tell. The BLS is working to fix this error which should make the rate next month more accurate. Even if the error shrinks further, the headline rate should still fall because of all the workers coming back to their jobs.

In this coming June BLS report, which is being surveyed right now, interviewers’ screens will flash a special notice when they use the “employed but absent” category. The notice will tell the interviewer to not use this for anyone who isn’t working because of COVID-19. Census officials will do more staff training to get this process down. We’re betting the error rate will fall.

The chart above shows the household response rate. As you can see, in the past couple surveys, the CPS response rate has fallen from the low 80s to the high 60s. The world has a funny way of working. Just when you most need to know how the economy is doing, the data becomes less useful. That’s just like how sometimes brokerages crash just when you need them the most. The increase in uncertainty and pervasive fear includes this all. Buying stocks when uncertainty is high gets you paid for a reason. You’re taking risk when the data is bad and uncertainty is high.

No Fed Funds Rate Hike Or Cut

The Fed didn’t hike or cut the Fed funds rate as we projected. The Fed won’t cut rates below zero because it isn’t stimulative. If the Fed didn’t cut rates below zero at a time when they were willing to do anything, including buying corporate and municipal bonds, it’s likely not going to happen. The Fed is willing to do whatever it takes, but cutting rates below zero won’t stimulate the economy.

Powell emphasized that the Fed won’t hike rates anytime soon. Powell said, “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates. What we’re thinking about is providing support for the economy. We think this is going to take some time.” The Fed can’t cut rates anymore, so all it has left is to say is that it won’t hike rates in the future.

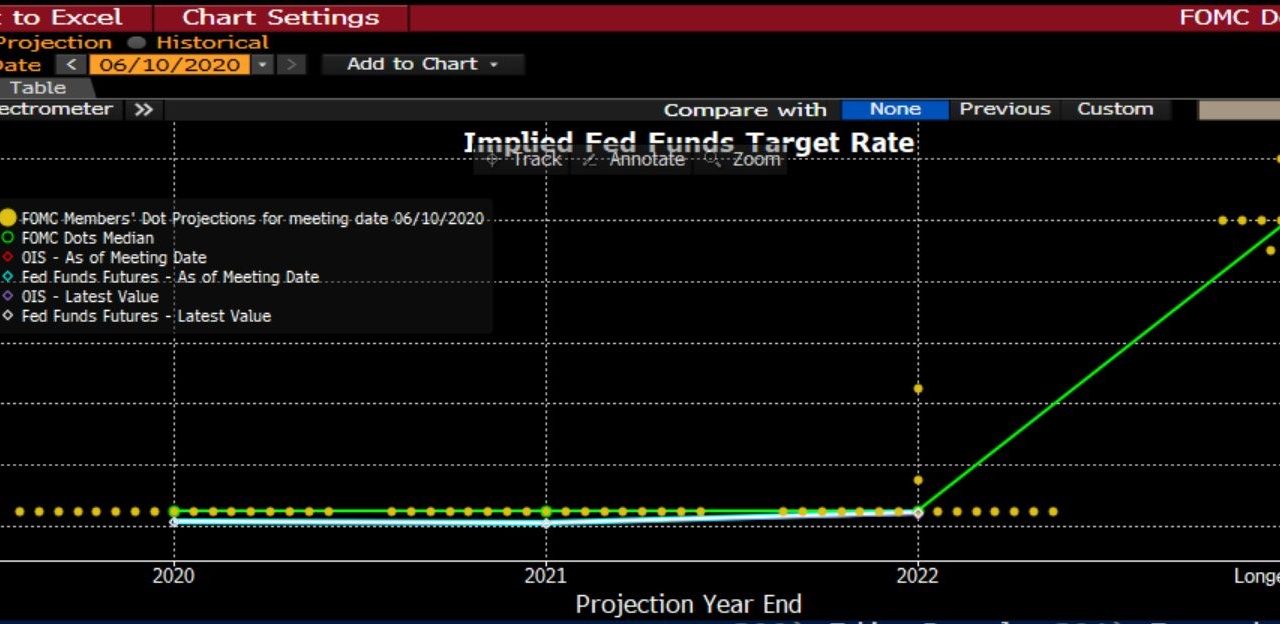

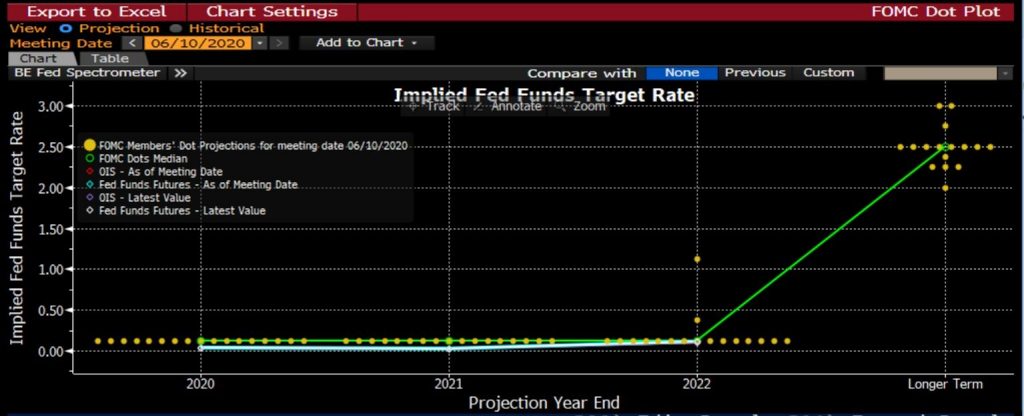

As you can see from the table below, the Fed doesn’t plan to hike rates through 2022. In tune with this, the Fed’s dot plot, which is the prediction each individual FOMC member makes, showed no members think the Fed will hike rates in 2021 and only 2 think it will hike rates in 2022. That’s out of 17 committee members. It’s important to note that the Fed is making guidance to affect markets now. This isn’t really a prediction. If the economy improves and inflation spikes, the Fed could easily hike rates in 2022. In fact, the market would price it in.

This situation is different than the last cycle when the Fed kept rates at the zero bound from late 2008 to late 2015. This could be a quick recovery if the government keeps up its stimulus and there isn’t a 2nd wave of COVID-19. The highest probability of the economy having long term issues is if the government doesn’t do enough to cushion the impact of the virus. If people become permanently unemployed and start to default on all their loans, demand won’t come back quickly. The businesses that are reopening, would be forced to close because of a lack of demand rather than government mandated shutdowns.

The table above shows the Fed thinks the unemployment rate will be 9.3% for the year. The Fed kept with its cautious forecast that it had in last cycle’s recovery. The unemployment rate almost always fell below where the Fed thought it would because the Fed didn’t realize the rate wasn’t structurally high. In this case, the Fed is just being careful in the face of uncertainty. We are nowhere near full employment. This forecast probably doesn’t have that much of an impact on policy because even in the most optimistic scenario, the Fed will likely stay with QE and ZIRP. Specifically, the average unemployment rate in the first 5 months of the year is 7.9%. That means the Fed expects the average to increase. That’s not a shock because the average is weighed down by the first 3 months.

The current rate is 13.3%. If the Fed’s prediction is accurate, the average rate in the next 7 months will be 10.3%. That’s quite high considering the expected decline in the next couple months as people who were temporarily jobless go back to work. We could have a clear picture on that projection’s inaccuracy as early as the first week of July when the June labor report comes out. If the rate falls near 10.3%, then its likely that the Fed is too pessimistic.

The Fed sees GDP growth being -6.5% in 2020. Then it sees a spike to 5% because of easy comparisons. The chart below shows the Fed’s weekly economic index.

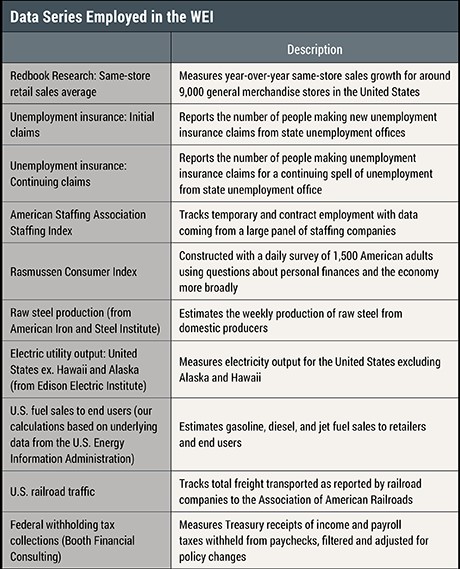

The data got worse in the past week which isn’t what the stock market has been pricing in (ignoring the crash on Thursday). This index includes Redbook same store sales growth which was bad as we mentioned in a previous article. The table below shows all the components of this index. Finally, we have the Fed’s estimate for inflation which is very low. That’s much different from the University of Michigan consumer survey which showed consumers expect inflation to pop. The Fed sees full year 2020 PCE inflation of 0.8% and core PCE of 1%. That’s why the Fed isn’t close to hiking rates.

Conclusion

The June labor report will probably have a smaller miscalculation. The household survey might have a higher response rate as the economy gets back to normal. The unemployment rate will probably fall even with the smaller error. The Fed was extremely dovish as you’d expect. It’s interesting that the stock market fell following that dovish statement and presser. You can argue that’s a bad signal because even the most dovish Fed couldn’t keep stocks up.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.