UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

It’s easy to cherry pick time horizons, but that can negatively impact your decision-making. It’s human nature to get scared of a sharp rally and be more comfortable with a stable market or one that is off its highs. Firstly, waiting for a dip is a difficult strategy to pull off because stocks can move higher while you are waiting for a decline. It feels good to buy when stocks are falling because you are getting a discount and it’s tough buy after stocks have rallied higher.

It’s provable that cherry picking time horizons is wrong because you can support both sides of the argument almost all the time. Even in today’s market where stocks have done amazingly, you can pick a time where they haven’t had breath taking returns. Specifically, the S&P 500 is up almost 40% from its December 2018 bottom which is an amazing annualized return. However, since the peak in September 2018, the S&P 500 is up about 15%. That’s a 17 month period, making these returns about average. If you can easily cherry pick time horizons to fit a narrative, it’s not the best idea to bother doing so. You should focus on future earnings and economic growth, not how well stocks have done in the recent past. If you say stocks are up X amount over the past X months, proving they can’t go any higher/lower, you are on the wrong path. People thought stocks had rallied too far too fast in Q1 2019; see how that worked out?

If we must look at past results, let’s tackle the elephant in the room. The elephant is whether this is a 10+ year bull market that is destined to end soon. The truth is if this was a 10 year bull market, it could still go further, economic and profit fundamentals permitting. With that being said, it’s probably not a 10 year bull market because, as you can see from the chart below, the S&P 500 has fallen over 20% twice already. 73% of stocks fell 20% or more in Q4 2018.

This bull market could be said to be only about 14 months old, not that it matters. It makes sense we haven’t seen huge bear markets because there hasn’t been a recession. The concept that a sustainable economy with mini bear markets and economic slowdowns, but no recessions has existed for over 10 years only doesn’t sit well with those calling for a major crash because they have recency bias. Don’t let the length of the bull market keep you from investing. Only become cautious if they are expensive and you are bearish on the future economy and profits.

Valuations Are High

Since we mentioned valuations matter, let’s briefly review the current situation. As you can see from the chart below, the S&P 500’s forward PE ratio is 19 which is the highest since 2002.

We’ve discussed the possibility of strong EPS growth and mediocre returns in 2020 (multiple contraction) since stocks started the year a bit expensive. Some say stocks should be expensive because the market is weighted more towards tech and less towards energy. If that’s the case, there’s little room for energy to fall any further. Energy is about 5% of the S&P 500 which is the lowest level in decades. Low energy prices have helped consumers this cycle.

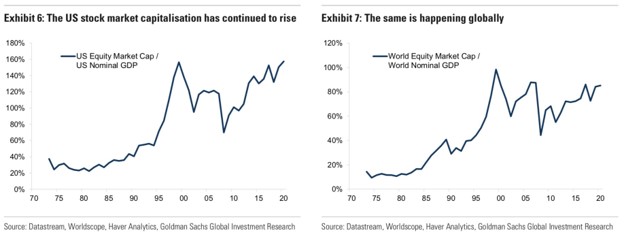

As we have discussed in articles in previous years, the U.S. stock market is much bigger than the entire economy. As you can see from the chart on the left, the market cap to GDP ratio is at a record high.

The counterpoint is always that American firms have international exposure. However, the chart on the left shows global equities are almost at a record percentage of nominal GDP. Recognize that the scale is different in each chart. Goldman Sachs stated, “While there is no reason that the stock market should fully reflect the domestic economy, it is nonetheless striking that despite fears of slower growth, stock market capitalization has continued to rise relative to the size of economies.”

Retail Traders Are In The Mix

There has recently been an increase in activity on the subreddit Wall Street Bets. The speculative positions these traders post are scaring experienced investors because they fear we are in a situation similar to the late 1990s. That subreddit is emblematic of the market. As you can see from the chart below, retail trading favorites have outperformed the equal weighted S&P 500 and hedge fund favorites.

As you can see in the chart on the right, there has been a significant increase in retail trading activity. We think it’s prudent to ignore the noise and just focus on valuations and the fundamentals. Retail trading is gaining more attention because commissions on trades have fallen, the labor market is nearly full (people have disposable income), and the advent of social media. There are secular and cyclical trends in place. However, recognize that the AAII investor sentiment survey has just 2.6% more bulls than average and 1.8% fewer bears. This isn’t a euphoric market.

Balance Sheet Doesn’t Matter

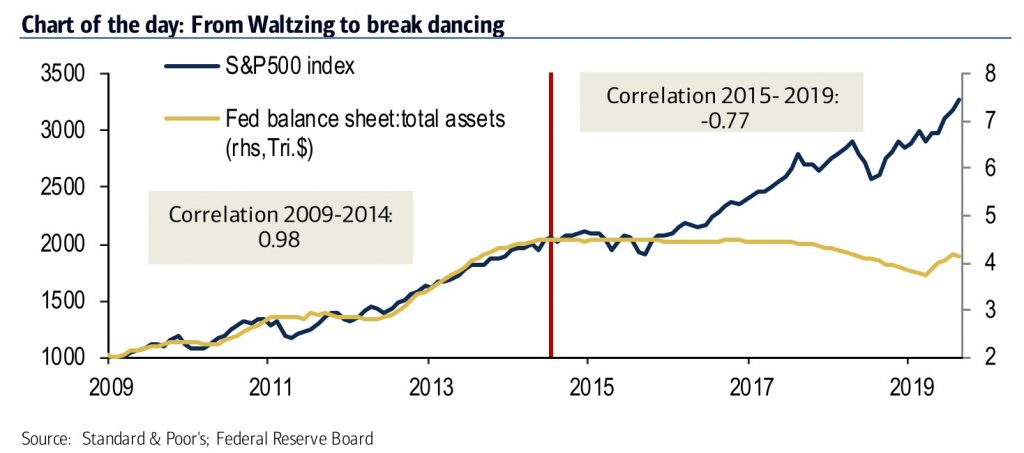

We’ve already discussed that the Fed’s balance sheet doesn’t matter to stocks, but it’s worth repeating since we have a fancy new chart from Bank of America. As you can see, the correlation between the balance sheet size and the S&P 500 has been -0.77 since 2014. It would be really easy to just follow Fed balance sheet policy when investing, but there are other factors in place such as global trends, cycles, sentiment, and fiscal policy. In more detail, the balance sheet impacts the economy in ways that can be both good or bad, which as a result impacts how the stock market responds. Simply stating that rising balance sheet equals rising stocks is wrong.

Conclusion

Don’t bother worrying how stocks have done recently when determining when to invest. Don’t just wait for a pullback. Follow the fundamentals of both companies and the economy. In the S&P 500, it has historically not made sense to wait to buy the index until it falls. However, that’s not an absolute rule. In other markets, it’s not so simple and the S&P 500 might not continue its fantastic run in the past century. Some valuation metrics show stocks are stretched too high, but recognize that strong EPS growth is coming outside of Q1 which will be hurt by the coronavirus. With zero fee trading, more retail investors have started participating and posting about their trades. Don’t follow their trades blindly, but also don’t think to sell just because they are buying. Finally, the Fed’s balance sheet isn’t correlated with the S&P 500.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.