UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The mega trends in the next decade are increased wages for workers and declines in corporate profit margins. The political tailwinds are in place. There is high income inequality; the large cap companies are earning extremely high profit margins. Politicians have these large cap firms squarely in their crosshairs. One proposal that supports this point is the global minimum tax.

Aligned with this trend is universal basic income which might be experimented with beyond the recent COVID-19 stimulus checks. We also could see an increase in union membership. Amazon employees have been attempting to unionize, but Amazon has thwarted some of these efforts. As you can see from the chart below, there has been a minor uptick in unionization in the past few quarters. This follows a very long period of declines since the 1970s.

Pensions are completely unknown to most millennials. Increased worker pay catalyzed by unionization would hurt the mega cap companies. In the long run, many companies plan to replace a lot of their workers with robots. While that’s the case, Amazon, for instance, increases its headcount each year. A spike in union membership could easily come before robotics causes workforce cuts. Now, it’s more about making workers more efficient than getting rid of them completely.

Supply Crashes Bubbles

In the past few months, we have been discussing that bubbles come cratering down when supply surpasses demand. In all bubbles, supply increases. For example, if there is a bubble in a commodity, supply will eventually be created to make money off higher prices. In an equity bubble, the financial world will make sure to take any company that is part of the bubble public. Sales and profits don’t matter in a bubble. Wall Street will take a company with a good name public if it thinks it will sell well. Is that Wall Street’s fault, or is it investors’ fault for encouraging such a situation?

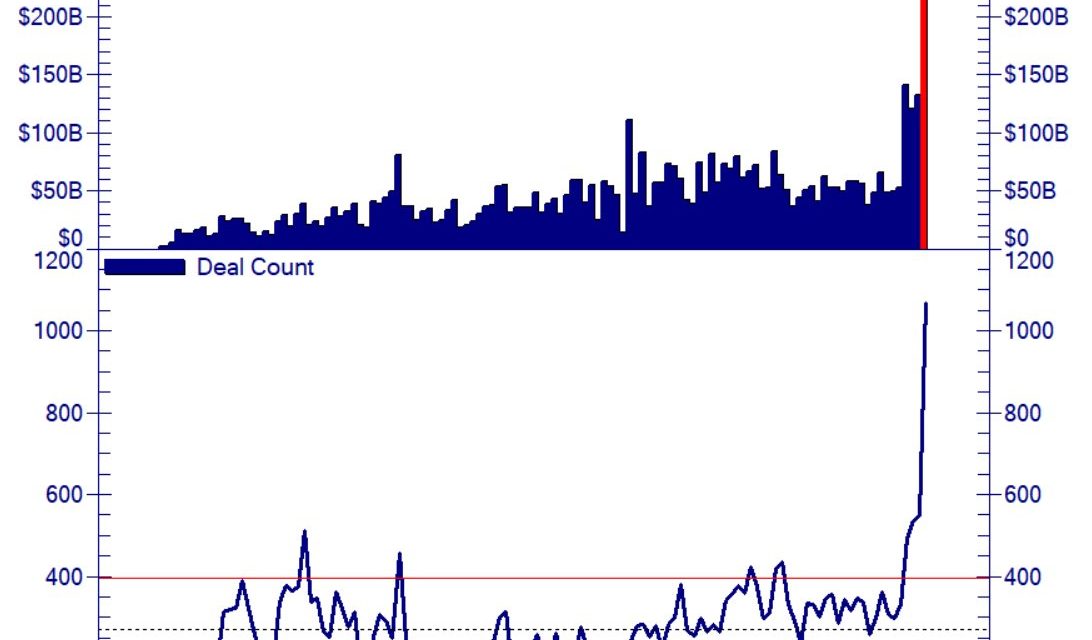

The equity deals have come fast and furious this year which has quelled the bubble. Demand can never exceed supply. The boost in supply is driven by greed just as much as demand is. If demand is so strong, that the business doesn’t matter, companies with poor businesses will go public. It’s pretty easy to found a terrible business if access to capital is high. As you can see from the chart above, equity offerings have exploded recently. Offerings will explode through the end of the bubble. Supply is like a fire extinguisher putting out a bubble in markets.

SPAC Bubble Over

Equity supply will continue to explode in the next few months in spite of the worries that demand is waning. As price performance worsens, people will begin to panic. There is nothing worse than a panic combined with a jump in supply. The chart below shows the coincident drops in non-profitable tech stocks, long duration stocks, and SPACs. Non-profitable tech stocks have been hurt by the economic reopening. SPAC stocks have been hurt by the rise in supply. Long duration stocks have been hurt by the spike in yields.

Obviously, in the past few weeks, the 10 year yield has fallen. It’s extremely important to note that many of the bubble stocks have fallen in spite of lower rates. The reality is stocks with extremely high valuations without profits are bad investments no matter where the 10 year yield is at. We made the point that if your stock crashed because the 10 year yield rose 100 basis points, you had a bad stock. Don’t blame the decline all on the macro environment. We should see the 10 year yield rebound in the next few weeks because the economy is still strong. The fundamentals haven’t changed. This was a correction.

Expectations Are Sky High

Earnings estimates are very high. This is looking like the tech bubble in the late 1990s. As you can see from the chart below, the bottom-up consensus long term earnings growth rate expectation is 16% which obviously can’t be sustained.

Earnings growth estimates will fall back down to the low double digits in the next few quarters which should hurt stocks. The biggest criticism of the forward PE multiple was that we were coming out of a recession which meant earnings estimates were too low. However, we are beyond that. Estimates have come up significantly. The numbers might be able to be studied at face value. The stock market is simply expensive.

Goldman Updates Us On Small Businesses

Goldman Sachs updated us on the state of small businesses. They are still in fragile shape even though they are quickly becoming healthier. Specifically, Goldman Sachs’ survey showed 77% of small business owners expect to exhaust their second round of PPP loans by the end of June. You would think that might be okay because the pandemic should largely be over by then in the US. However, the survey also showed only 26% of small businesses getting help expect to be able to maintain payroll without additional help.

It’s possible small businesses are too pessimistic. At the same time, you have to wonder how they can’t see the pandemic ending. Most should be aware the death rate has fallen sharply and the vaccination process is going well. There will be a certain point where if a business can’t do well, it shouldn’t exist anymore. One other possibility is small businesses are just saying they won’t be able to make payroll just to get the government to give them more loans. These are all potential answers since this weak reading is being paired with a boom in economic activity. Even the worst hit areas of the economy in 2020 are doing well.

Conclusion

Union membership could increase in the next decade. Income inequality is a big issue; large cap companies are being scrutinized for it. Taxes might also increase. Equity supply increased in the past few quarters which put out the fire in bubble stocks. The SPAC stocks have had a terrible few weeks despite the decline in the long bond yield. Earnings estimates are sky high. The revision ratio can’t indefinitely stay this strong. Goldman shows a high percentage of small businesses need more government support despite the strengthening economy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.