UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

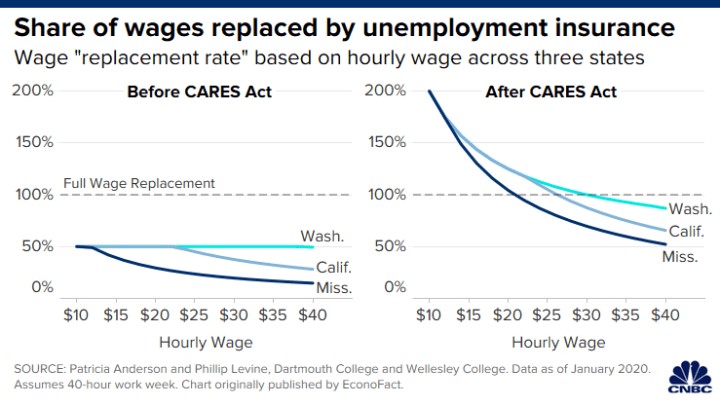

We’ve seen a spike in people not wanting to work which has been caused by the fact that it can be dangerous to be out in public combined with the extra pay some workers are getting via unemployment insurance. Some worry about disincentivizing work, but this policy is temporary. Plus, helping some people who get paid near the minimum wage is far from the worst negative consequence a fiscal policy can have.

The consequence of bailing out the banks in the financial crisis was helping investors who owned assets. This consequence is much better. The extra $600 per week in unemployment insurance is only for 4 months. If the economy starts to reopen this summer, there will be some competition with the government. However, many will want the security a job offers because they know the unemployment benefits will quickly go away.

You can see in the chart above, those making below $15 per hour in California, Mississippi, and Washington get paid more to be unemployed than to work. Some small businesses that are getting loans turned to grants if they pay their workers are being met with disappointment from their workers because they prefer to get unemployment benefits. As the risk of working decreases and benefits get close to ending people are going to want their jobs back. They won’t want someone else to take the job they previously had.

Most states offer unemployment benefits for 26 weeks. 2 offer it for more than 26 weeks and 7 offer less than 26 weeks. In the last recession, these benefits were extended. It makes much more sense to boost benefits rather than extend them in this recession because it is a short extremely brutal recession. If the shutdowns last longer than most expect, or if the virus comes back, the benefits will be extended. These boosted benefits are hugely beneficial to limiting the scope of this recession.

44 states are paying the extra $600 per week from the federal government. Only 9 states are paying unemployment insurance to self-employed people and others who usually aren’t included. 2 states are paying out an extra 13 weeks of coverage.

This Is The Bottom?

Dutta of Renaissance Macro was quoted as saying “THE ECONOMY HAS BOTTOMED, THERE I SAID IT.” This was partially based on the fact that mortgage purchase applications increased in the week of April 17th (2.1% weekly) for the worst time since the week ending March 6th. The 6 week change was still down 33.6% which was the worst decline since 2010 when the homebuyer tax credit expired. That prediction is also based on the 6.4% weekly increase in motor gasoline demand which was the first increase in 5 weeks. The economy isn’t robust, but there’s not much room for it to fall further. That’s similar to the peak in initial claims. The data just couldn’t get any worse. We won’t see a real uptick until the economy starts to reopen in either May or June.

Small Business Data

Womply has great data on small business sales. On April 17th, there was 54% sales growth in grocery stores. Sales growth at grocery stores has started to accelerate in the past several days after plummeting following the hoarding period in mid-March. As you’d expect, there was a 67% decline in travel and tourism. However, the worst decline was 84% in late March. We are above a complete shutdown, but that’s not exactly something to cheer about. These are still unbelievably bad numbers. If they last more than a few more weeks, the economy will be devastated beyond easy repair.

The chart below shows the similar bottoming in restaurant sales growth. The bottom was a 68% yearly decline on March 22nd. Now we are at a 41% decline as people are ordering food for pickup or delivery. It will be easy to improve on these numbers when restaurants reopen for diners in the next month or two (even with social distancing).

Forbearance On Mortgages

We thought there wouldn’t be another housing crisis, but when the economy shuts down everything becomes a source of chaos and uncertainty. The extreme job losses and the urge for people to want to save money for immediate necessities like food and water have led to a big spike in mortgages being put into forbearance. Many people didn’t have enough savings to deal with this crisis. As you can see from the chart below, 5.95% of loans by Ginnie, Fannie/Freddie, and other are being put into forbearance. The great news is this isn’t like the housing bubble in which people lost their homes. The situation should normalize when the shutdowns end.

Extreme Dislocation

We mentioned in an article in February that intrinsic value isn’t impacted much by a short decline in earnings. That doesn’t mean declines in liquidity can’t cause sharp selloffs. Those are buying opportunities for long term investors. According to the Man Institute, when the S&P 500 was down 33%, it was pricing in zero earnings immediately and then taking 7 years for earnings to get back to the pre-crisis trend. The recent rally in stocks in the past 20 days has been the 2nd best ever. Some are concerned that the market has rallied too fast. The reality is it fell too fast based on intrinsic value investing.

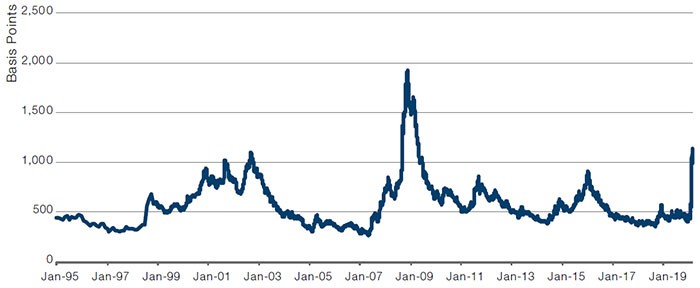

The chart below shows the yield to worst spread has spiked.

The high yield market is pricing in a 40% default rate over the next 5 years even though the rate was only 14% in the great financial crisis. It could be higher than 14% because of the crash in oil, but 40% is unreasonable. Investment grade is pricing in an 11% default rate over the next 7 years even though the default rate was 1% in the great financial crisis and 3.6% in the Great Depression. That’s too negative of an expectation.

Conclusion

Some people are getting more money to be unemployed than to work. That’s probably going to cushion the blow of this recession as the poor usually are hit the hardest by recessions. Renaissance Macro believes the economy has bottomed and the data agrees. There has been a spike in mortgages in forbearance. The stock market was too low when it was down 33% based on intrinsic value investing. The bond market is pricing in a 40% default rate on junk bonds and an 11% default rate on investment grade bonds. Both expectations are too negative.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.