UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The stock market rally in 2021 has been driven by better than expected earnings which means it isn’t in a bubble. The only way this is a bubble is if the earnings are unsustainable. Many firms in the technology sector are about to face tougher comps which should lower their growth rates, but that doesn’t imply there will be an earnings crash. Heading in this year we expected earnings to explode and stocks to lag them.

Hypothetically, you could see EPS growth of 25% and the stock market increase 10% (numbers for illustrative purposes only). This implies multiple contraction; the stock market came into the year with a high multiple. However, there were plenty of cheap stocks that would benefit from the reopening that could rise more. It’s not usual for stocks to perform weakly in years with high earnings growth. Performance depends on expectations. If earnings were expected to rise prior to the results, EPS improvements were priced in. At that point, investors are looking at the inevitable drop in earnings growth. If the EPS growth acceleration wasn’t expected, then stocks can rise on good results.

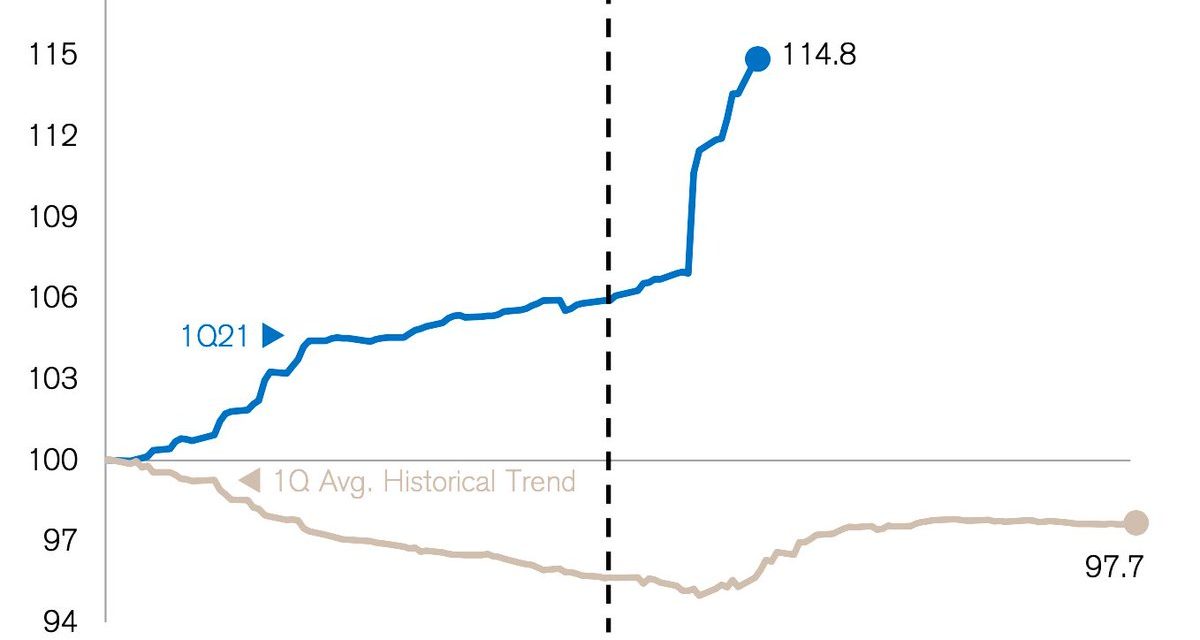

There is no rule on what stocks have to do. In stock market bubbles, you don’t even need to see earnings for prices to go up. That’s what we saw with many segments of the market in the 2nd half of 2020 and early 2021. In looking at the S&P 500, it makes sense to have a healthy respect for current valuations and expectations. Don’t become cynical because stocks have done very well. Stick to the facts. As you can see from the chart above, EPS expectations for Q1 have gone vertical now that earnings season has started.

We are getting beats above normal along with guidance increases. Many of America’s strongest companies are raising their outlooks. It’s very common for analysts to simply make estimates that are towards the high end of guidance ranges because analysts bake in company conservativism. It’s a nice game where if everything goes according to plan, companies usually beat EPS estimates slightly. Even after acknowledging this game, results have been fantastic. As you can see, the historical trend is only for blended EPS estimates to rise mildly in April. Q1 has been above and beyond the norm.

Equity Sentiment Is Mostly Heated

The stock market is in the midst of a historic rally. The rally since the end of March 2020 is unimaginable. Even the increase since late October is crazy. The Russell 2000 is up 49.2% in the past 6 months. We don’t need to tell you that’s not a normal return. Clearly, things are overheated. It would be shocking to see any sentiment indicator that isn’t flashing a warning signal.

Let’s start with the AAII sentiment survey. This one has gotten much less bullish in the past 3 weeks after tagging the highest level since January 2018. In the week of April 28th, the bulls totaled 42.6% and the bears totaled 25.7%. Investors in this survey are only slightly more positive than usual. The stock market didn’t even fall in the 3 week period in which bullishness fell 14.3%. That’s amazing because if sentiment can cool without a decline, stocks can move higher indefinitely (outside of a negative catalyst). However, the AAII survey isn’t the only sentiment indicator. Judging by the price action, investors are very bullish. Some say price is the ultimate sentiment indicator.

The NAAAIM fund manager exposure index shows extreme optimism. The index rose from 95.6 to 103.72. That means the average fund is leveraged long. This typically isn’t bad for returns, but keep in mind the stock market has been going up most of the time this survey has existed. Can anything be a negative indicator, if stocks have mostly gone up since March 2009? The data since 2009 might create bias in itself because most permutations will spit out positive results.

The final indicators to review are from NDR. The daily trading sentiment composite is at 68.89 which is in the excessive optimism category which is usually bad for stocks. Similarly, the crowd sentiment poll is at 73.3 which is also in the extreme optimism category which is bearish again. We wouldn’t sell stocks because of sentiment because it’s just one type of indicator. However, a correction occurring in the next few weeks is more likely than it usually is.

Margins Are Expected To Explode

We have previously discussed the premise that corporate margins will increase in the short term due to the reopening and decrease in the long term because of political pressure and higher wages. Wage inflation in 2022 should be a headwind for earnings just like commodities are a headwind now. As you can see from the chart below, the consensus is way different from our expectation. This explains why stocks have done so well despite high valuations.

Margins are expected to rise in 2021 back to their prior peak in 2018 which makes perfect sense. However, the expectation that they will rise in 2022 and 2023 seems overly bullish. The consensus suggests governments will do nothing to curtail earnings and that higher wages won’t be an issue. The consensus is just drawing a line from the bottom left to the top right. Investors should consider potential margin compression or margins not meeting estimates as risk factors. On the positive side, the big internet companies have high margins. They are becoming a larger portion of the market. In fact, the stock market is more concentrated than it has been in a few decades. These are the exact firms that could face more regulations.

Conclusion

The stock market is being driven by great earnings, meaning this isn’t a bubble. However, most sentiment indicators show there can be a correction in the near term. Furthermore, the price appreciation seen in the past 6 months can’t continue indefinitely. The consensus calls for higher profit margins in 2022 and 2023. That might be too optimistic if wages spike and governments increase regulations.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.