UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

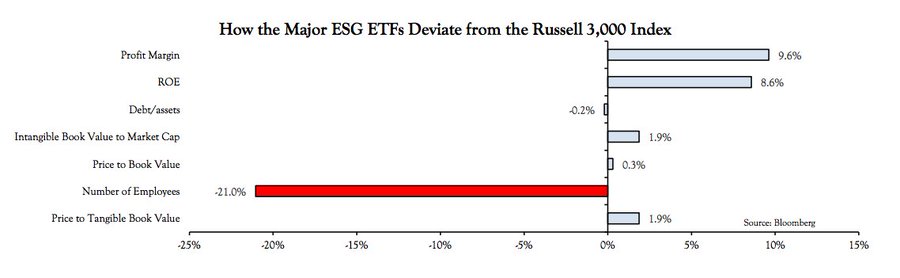

In our previous article we mentioned ESG is the equivalent of going overweight tech and underweight energy. That makes this factor look like it’s following momentum more than making a difference. The chart below adds new information about what an ESG investment is. As you can see, major ESG ETFs tend to include firms with fewer employees. This is the asset light trend we’ve noted previously. Fewer workers mean less carbon dioxide emitted, less trouble with unions, and less chance of a gender pay gap.

It’s extremely dubious to suggest the solution to worker pay and equality is to just not hire anyone. In a sense, investing in these firms penalizes everyone equally. There are unintended consequences to trying to invest ethically. It sounds good in theory, but there are problems with it in practice. Keep in mind, it’s possible to invest in an energy stock and use those profits to buy an electric bike for transportation. Your spending habits and where you donate your money can make an impact, while your portfolio makes you money.

To be clear, buying stocks with fewer employees and certainly owning stocks with high margins and high return on equity aren’t bad ideas. We’re just explaining what ESG investing entails. It makes sense the factor has done well in the past few years based on the details we laid out. However, we wonder if it will lose popularity if it doesn’t do well. Secondly, most companies are trying to be ESG. Even energy and cigarette companies are trying to be included in these indexes. If everything becomes ESG, then there isn’t much to it. Finally, it’s worth noting it’s extremely important to have management have the correct long term incentives. This isn’t about morality; it’s about long term stakeholder profits.

Labor Was Doing Well

Let’s take a moment to recognize that workers were doing relatively well before this recession. It’s amazing how cyclical political goals for labor versus corporations are. When the economy is in a recession, the government tries to support businesses to help them keep workers. When the economy is near the end of an expansion, there are pushes to raise the minimum wage and have workers make more money. When the economy is doing well, rich people profit which causes real wage growth and low unemployment to get pushed aside making it look like workers are doing poorly. Outside of the fiscal stimulus, we can safely say now workers are doing poorly.

As you can see from the chart above, workers had been making gains in the late 2010s. Employee compensation as a share of net value added for non-financial firms increased from about 67% to about 73%. It’s not politically correct to say workers were doing well. However, cyclically it was correct. Of course, there’s always a desire to have workers do better. In fact, they were about to have a very strong year in 2020 before the virus hit. We were about to get an acceleration in the economy along with low inflation.

Disastrous Jobless Claims Report

The jobless claims report in the week of June 20th was terrible again. That’s 2 weeks in a row of weak declines on a seasonally adjusted basis. Last week, claims were revised from 1.508 million to 1.54 million. This week there were 1.48 million claims which was 100,000 above estimates. On a seasonally adjusted basis, claims fell 1.7% last week and 3.9% this week. As you can see from the chart below, claims fell 4%, 6%, and 0% on a non-seasonally adjusted basis. Furthermore, there were 728,000 PUA claims which was a 43,000 decline. That’s 2.2 million in total. In the past 3 weeks, this total of claims fell 6%, 1%, and 2%. The labor market recovery is inching to a crawl.

The labor recovery is flailing probably because all the workers who were immediately able to be added back to payrolls because of PPP loans were already added in May. It’s unlikely that the stoppage of the reopening in Florida and Texas had an impact on claims yet. However, this is a new potential negative catalyst. In the 4 states that are doing the worst with COVID-19 (Arizona, Texas, California, and Florida), only Texas’ claims fell. 9 States had significant increases in claims in this report.

Continuing Claims Might Not Be Improving

This week’s report of continued claims matches the survey week for the June BLS monthly labor report. That report is coming on Thursday because markets are closed on Friday because of the 4th of July holiday. Continued claims fell from 20.289 million to 19.522 million. Last month, there was a massive drop from 24.912 million to 20.841 million in the survey week of the BLS report. Since it correlated with the great reading, this, along with initial claims, suggest the June labor report won’t show as many jobs added. It’s extremely difficult to game that report, but it’s easy to see the recovery isn’t as strong as the stock market suggests with its great rally (outside of the recent correction).

As you can see from the chart below, when you add in all the government unemployment benefit programs and those waiting to get benefits, the total increased and is near its recessionary peak.

There are 33.1 million in total. There are 17.9 million regular state continued claims, 1.5 million regular state initial claims, 11 million PUA continued claims, 1.5 million initial PUA claims, and 1.2 million in other programs such as PEUC (pandemic emergency compensation) and STC (short time compensation). This chart combines the most recent data on initial claims with latest data on continued claims which lags a week. The conclusion is that the government needs to continue to support these workers. The extra $600 per week expires in the week of July 25th.

Conclusion

ESG funds reward firms that don’t have as many workers. You can’t have problems with paying workers too little if you don’t have any to begin with. Ironically, the solution to union troubles hurts workers even more. Workers were making gains in the late 2010s even though few admitted it. Now the labor market is a disaster. When you combine all the latest data and the special new unemployment benefits programs, the labor market isn’t improving by as much as the headline May BLS report suggested. The June labor report might not be as strong (in terms of jobs added).

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.