UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

February’s headline job creation of only 20,000 was a disaster as it missed Bloomberg’s estimate by 160,000 jobs which is the biggest miss since November 2008 which was the heart of the financial crisis. This report was so weak, it came close to ending the record long 101 month streak of job creation. The sequential job creation decline of 291,000 was the 3rd biggest drop since June 2010.

As you can see from the chart below, January’s job creation was amazing as it was revised up from 304,000 to 311,000.

The weak February report was a surprise because jobless claims are still near historic lows and the ADP report showed 183,000 private sector jobs added. The biggest difference between the ADP report and the BLS report was in construction as ADP said the industry added 25,000 jobs, but BLS stated it lost 31,000 jobs.

In a broader sense, this was probably a one off weak report. The 3 month average job creation is still 186,000 and the 12 month average is still 209,000 which is solid. Employment was up 1.9% from last year. While that growth rate is down from 2.2%, it’s still solid. In recent years, there have been a few one-off bad job reports. Reports of job creation of 15,000 in May of 2016 and 18,000 in September of 2017 were followed by reports showing 282,000 and 260,000 jobs added.

It’s worth noting that this was the 3rd recent near-recessionary economic report as the December retail sales and December housing starts were bad. Housing starts and retail sales rebounded in January, showing us the February jobs report could be a blip.

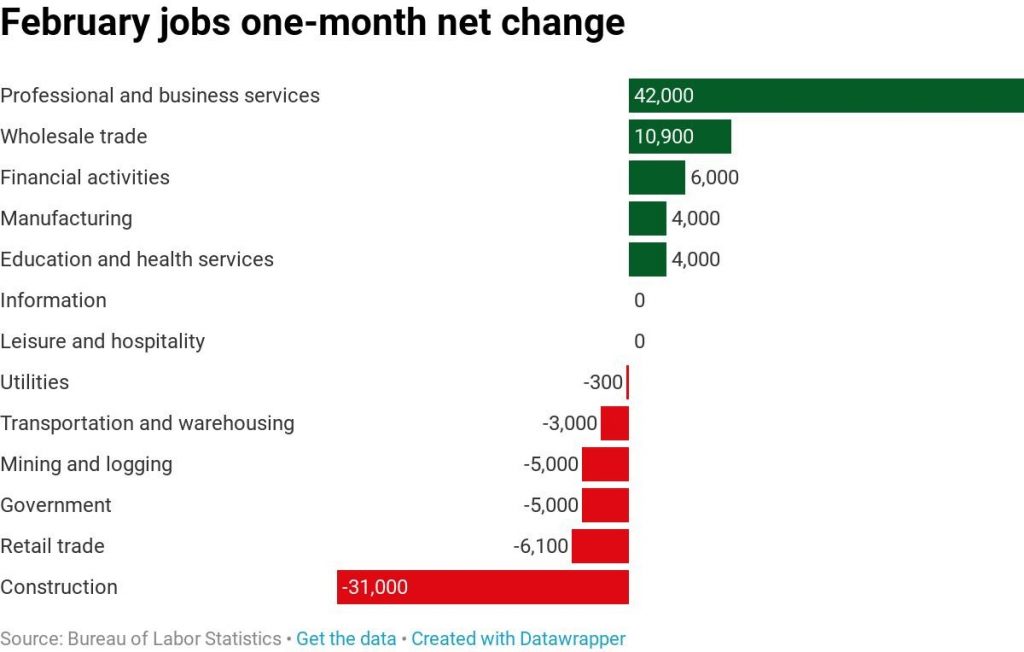

Breakdown Of Where The Jobs Were/Weren’t

As we mentioned, construction hemorrhaged jobs. There has been weakness in residential housing although January housing starts improved sequentially. It’s notable that in recent years construction employment has grown much quicker than construction volume. This job weakness could have been catalyzed by the heavy precipitation in the West and Midwest which was noted in the BLS report as a catalyst for the decline in the length of the construction work week.

The ADP report was correct about leisure and hospitality being weak and professional and business services being strong. The manufacturing sector only added 4,000 jobs which was down from 21,000 last month and missed estimates for 11,000. That makes sense given the declines in the ISM and Markit manufacturing PMIs.

U3 And U6 Rates Plummet

Even though job creation was weak, the unemployment rate fell from 4% to 3.8%. This exemplifies why it was impractical for bearish investors to assume 3.7% was the bottom for the cycle and that the labor market was turning because the rate increased slightly. The labor market added an amazing 311,000 jobs last month, but the unemployment rate increased 0.1% because the civilian non-institutional population fell more than the labor force. Small changes to the unemployment rate don’t signal cycle changes. It’s easy to be mislead by this if you don’t do the research.

As you can see from the chart below, the U6 unemployment rate which includes those working part time for economic reasons and those marginally attached to the labor market, cratered from 8.1% to 7.3% to a new expansion low.

In January, the number of part time workers soared because of the government shutdown, so the rate spiked 0.5%. That change doesn’t take away from this massive swing. The rate is below last cycle’s trough of 7.9% in December 2006. It is closer to the trough of 6.8% in October 2000. The labor market is inching towards full employment.

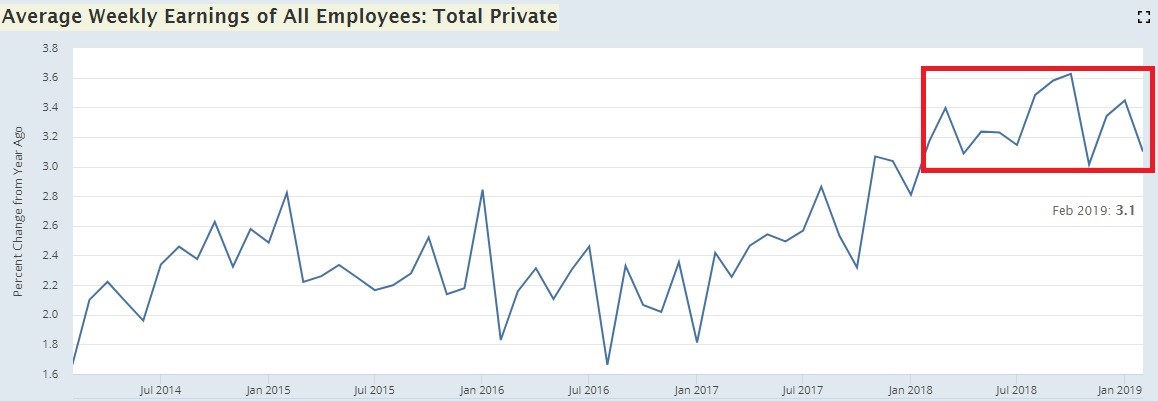

Weekly Wage Growth Fell

This month’s report was a case of average hourly earnings growth being deceiving. Average monthly hourly earnings growth of 0.4% beat estimates for 0.3% and was above January’s growth of just 0.1%. On a yearly basis, growth accelerated from 3.2% to 3.4% which beat estimates for 3.3%.

Before you get excited, recognize that the average work week length fell from 34.5 hours to 34.4 hours which missed estimates for no change. While that decline in the work week length doesn’t seem like a lot, it was enough to push year over year weekly wage growth to 3.1% from 3.4%. The good news is, as the chart below shows, weekly wage growth has been in a range of 3% to 3.6% since February 2018. You’d expect wage growth to improve as the labor market gets tighter, but weak February job creation limited that potential.

The Labor Market Isn’t Full

The labor market isn’t full yet even though this is about to be the longest expansion since the 1800s and this is by far the longest streak of job creation ever. The overall labor participation rate was steady at 63.2% which met estimates.

As you can see from the charts below, the age adjusted labor force participation rate is below last cycle’s peak and much below the peak in the late-1990s.

The prime age labor force participation rate fell 0.1% to 82.5%. That’s not a surprise because the rate has been increasing in a way where it takes 2 steps forward and 1 step back. It spiked 0.3% in January and gave some back in February. The rate is now 0.9% below the previous cycle peak. If the rate increases 0.4% per year as it has in the past year, it would take 3.58 years for the rate to reach the average peak in the last 3 cycles. The labor market is still decently away from full employment.

Conclusion

This wasn’t a good labor report because job growth was only 20,000 and weekly wage growth slowed from 3.4% to 3.1%. However, there’s no need to panic because there have been a few randomly weak reports this cycle. Job growth has always bounced back. Since jobless claims are still low, there’s no reason to expect this jobs report to be the new normal. The economy is in a slowdown, but it’s not as weak as the February labor report indicates.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.