UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The labor market continued to get better in the week ending May 29th. Seasonally adjusted jobless claims fell 20,000 to 385,000 which was 15,000 below the consensus. The 4 week average fell 30,000 to 428,000. It’s inching closer to our projection for it to fall below 300,000 by the end of the year. In the week of May 22nd, continued claims rose from 3.602 million to 3.771 million which as the highest reading since March 13th. This is probably a blip that will reverse course next week.

Non-seasonally adjusted pandemic claims fell 2,000 to 76,000. This program is going away very soon. In June, 4.1 million people will come off pandemic benefits. Let’s see how that impacts job creation and consumer spending in the next few weeks. We think job creation will pick up in June. The savings rate should decline which might make up for the decline in benefits. The economy is a few months away from complete normalcy.

As you can see from the table below, total claims in the week of May 15th fell 366,000 to 15.4 million. In a couple months this will be below 10 million as the pandemic programs run their course. We will probably stop following this statistic in July. We will just study initial and continued claims. Soon initial claims will be back to its normal reliability which is important since it has a high correlation with stock returns.

Modest Wealth Declines

As you can see from the chart below, at age 40 each subsequent generation has had a similar income, an increase in debt, and a decline in wealth. The increase in debt for millennials is likely due to student loans.

It takes longer for young people to get ahead financially; they often have zero net worth in their late 20s. The good news is the millennial generation is the most educated generation ever. In theory, millennials will make more money in their 50s and 60s than prior generations. It depends how well they adapt to changes in technology.

Furthermore, it will be interesting to see if the past 2 years changed anything. Obviously, we’ve seen a slew of 30-something millennials buying houses. Many bearish economists claimed millennials would never be able to afford houses. There is a dramatic difference between life events occurring a few years later and them not occurring at all. Millennials need to build up equity and pay down their student loans to grow their net worth. In the pandemic, many student loan payments were delayed. Since millennials are so highly educated, it means they were more likely to work from home than older generations which probably boosted their savings.

People Want Life To Go Back To Normal

The COVID-19 pandemic is over in America and a few other countries due to successful vaccination efforts. It’s definitely not over in many emerging markets such as India and Brazil. Countries who have controlled the pandemic should put their efforts towards helping the ones with vaccine distribution issues. In America, the 7 day average of new COVID-19 cases has fallen to just 15,037 as of June 3rd. That is the lowest reading since late-March 2020 which was just a couple weeks into the pandemic when there wasn’t much testing. The 7 day average of new deaths fell to 428 which is also the lowest since late-March.

As you can see from the chart below, 56% of Americans in late-May said they wanted to lead normal lives as much as possible. That is the highest reading since the pandemic started. It finally passed the percentage who want to stay home as much as possible. This survey is actually a delayed reaction to the vaccination results. People probably need a few weeks to psychologically adjust to the changes. The first big moves back to the office will be in June. We should see the office occupancy rate spike this summer. Many are projecting everything to be back to normal by Labor Day. Many areas are ending mask mandates.

A Few Big Winners

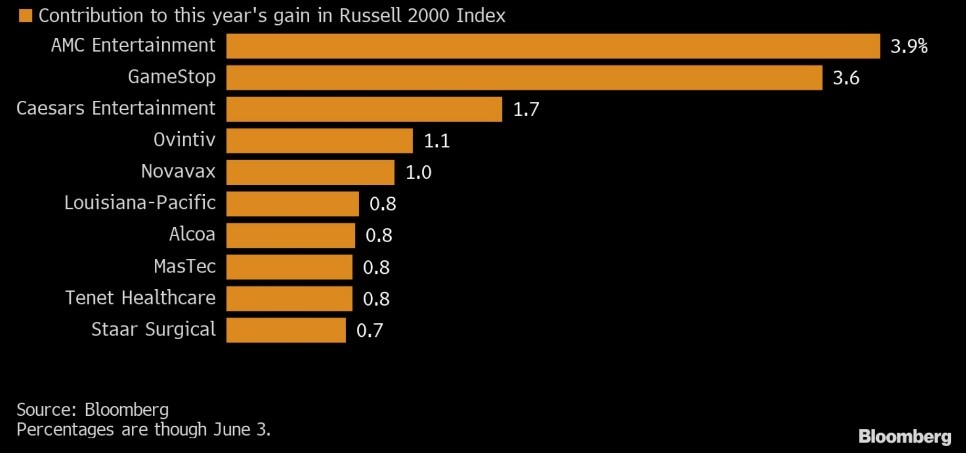

A few companies have had an outsized impact the Russell 2000’s returns this year. The meme stocks have impacted the index so much, it can’t be relied upon. Furthermore, the value index also can’t be relied upon because many of the story stocks that exploded started out in that index. Of course, those who buy these stocks are either betting on sharp future growth or just momentum in the price action.

As you can see from the chart below, AMC and GameStop alone have contributed 7.5% of the small cap index’s year to date returns. This matters if you are buying the whole index. However, if you are buying boring companies, this is irrelevant. Don’t think to yourself that your stocks can’t go higher just because the small cap index is high. Many solid companies have made new highs since the peak in the Russell 2000. It’s down 3.1% since March 16th.

This Is Noise

The meme stock revolution this year has been covered relentlessly in the media and discussed a lot on social media. It is covered this much because it generates entertainment/awe. It enamors people because it’s nonsensical. However, most people aren’t investing most of their money into high flyers. The pie charts below are a mental model for how to comprehend this.

The media covers top 5% hottest stocks in people’s portfolios relentlessly while ignoring the normal news about the other 95%. It can drive you insane if you don’t tune it out or only watch for entertainment purposes. Even story stocks like Netflix and Tesla are no match for the show meme stocks put on.

Conclusion

Jobless claims fell again. This bodes well for the June labor report. As of 2019, median incomes were down for millennials. Let’s see if the pandemic economy impacted this. Most Americans want life to go back to normal because the vaccine has all but ended the pandemic. It’s the most contained since March 2020. The meme stocks have moved a few indexes, making them irrelevant. Don’t study these indexes when contextualizing individual investments. The meme stocks make up most of the news, but they are a very small part of Americans’ portfolios.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.