UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

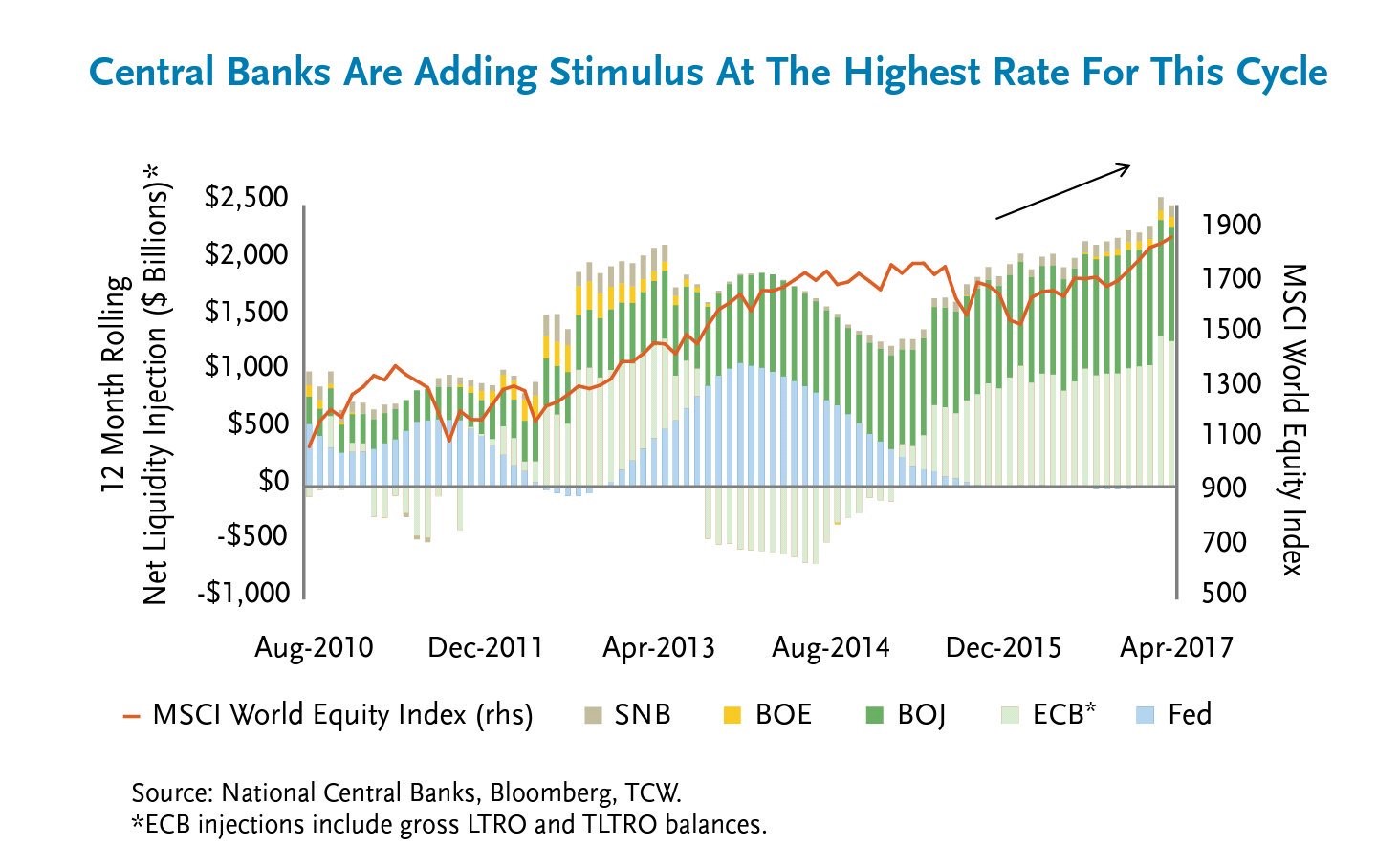

In previous articles (here and here), we’ve discussed how central banks are going to halt adding liquidity into the financial system which could cause a correction in the stock market. Many people scoff at that idea because they look at the current market and say, “what could possibly go wrong?” This is recency bias at work as many investors have never experienced a sizeable market correction. Stimulus reached the highest level of this cycle. Quantitative easing has been among the most important drivers of the rally in asset prices for the past 8 years, once discontinued, the opposite will happen – namely a decline in asset prices.

If you are an investor who is skeptical of the efficacy of central bank stimulus, you might be confused why anyone would believe that taking away the stimulus isn’t a big deal. The reason is because some bears have promoted a false narrative. You can see that narrative in the chart below. It shows the S&P 500 versus the Fed’s balance sheet. The balance sheet has stayed at the $4.5 trillion level while stocks have moved higher. There have been bears claiming the sky is falling since the Fed stopped its bond buying in 2015. Stocks had some volatility afterwards, but have since moved higher. The thesis that stocks would fall when the Federal Reserve stopped buying bonds was proven incorrect. This makes some investors think that global balance sheet shrinking won’t be a major factor for stocks. However, these investors are missing the chart above. The reason stocks have rallied since early 2016 is because of global QE in which the Fed didn’t participate.

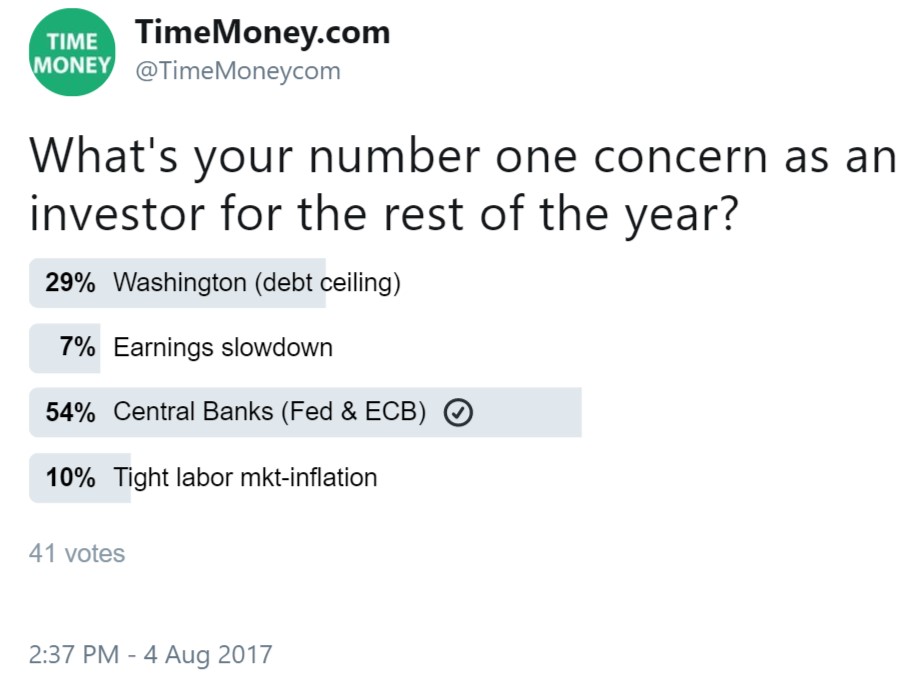

We asked our audience on Twitter what the number one concern for investors is for the rest of the year. Let’s review the risk options in detail.

The first option which got the second number of votes is the debt ceiling. The debt ceiling is approaching in October. Since the Republicans didn’t get enough votes to pass healthcare reform they don’t have the momentum to work together to get the debt ceiling increase to pass easily. This is the logic behind worrying about the debt ceiling – there is increased noncooperation within congress. Most investors know it will be passed, but the longer it is drawn out, the more likely it will cause volatility. The black swan event would be another debt downgrade like when S&P downgraded the U.S. in 2011.

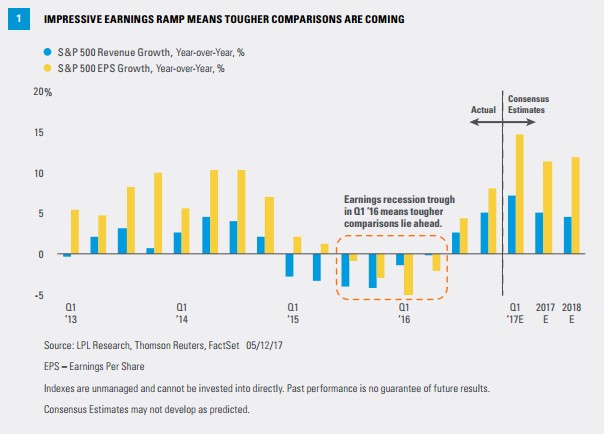

The second option is the earnings slowdown. Year over year earnings growth have been boosted because of weak energy earnings in 2016 making for easy comparisons. Looking at the numbers, the energy sector had a -2.43% contribution to S&P 500 earnings in Q2 2016. That’s what the current earnings period is being compared to. Clearly energy earnings have a low bar to jump over. The current estimate is for a 3.55% contribution in Q2 2017 making the year over year growth rate reach the triple digits. Q3 2017 energy earnings which will be reported in October and November have a much tougher comparison as the Q3 2016 energy earnings contribution was 0.92%. In terms of the overall market, the ‘as reported’ earnings recession bottomed in Q1 2016 as you can see in the chart below. That made the first two quarters of the year have very high year over year growth. Those easy comparisons are now gone. This option in the poll did the worst as some investors might be looking at the weak dollar as a catalyst for improved sales growth in Q3 and Q4 2017.

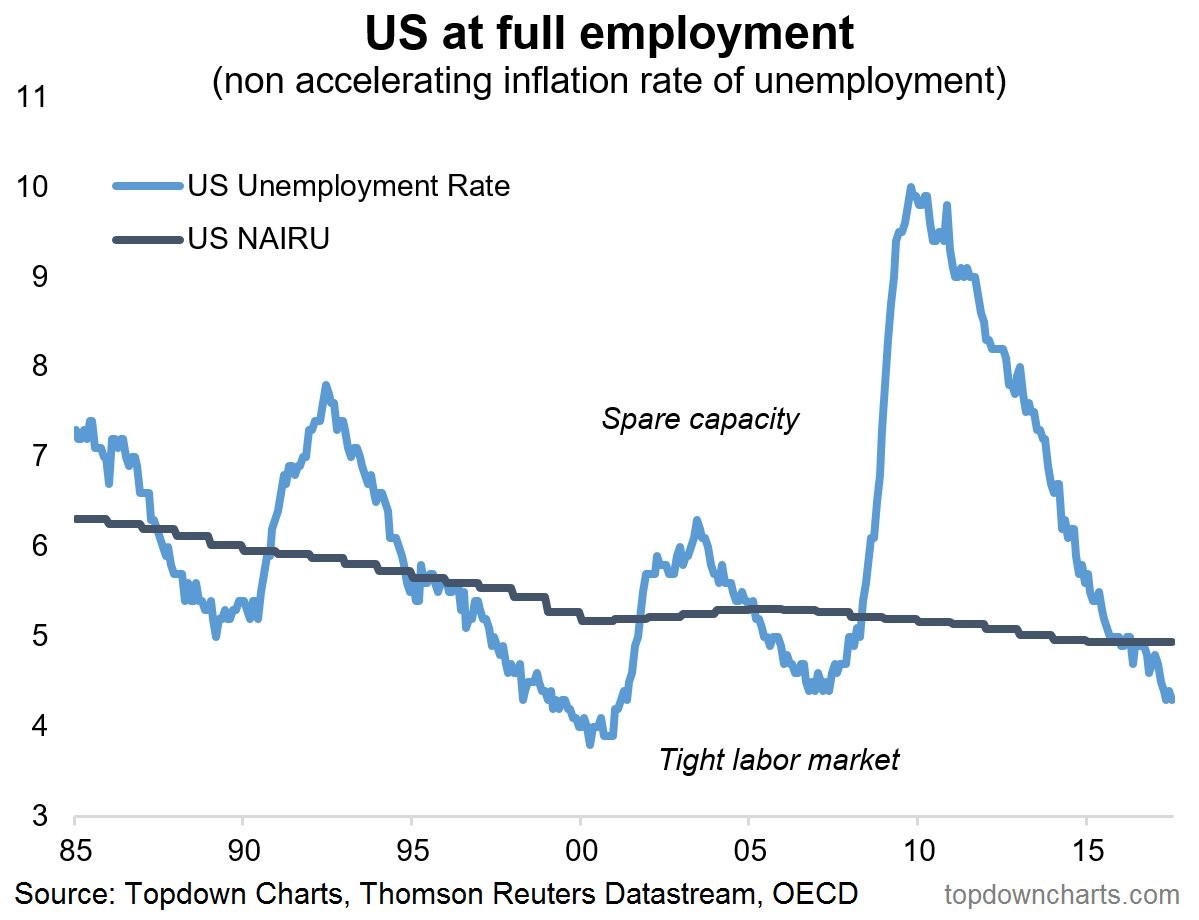

Let’s skip the third option and look at the potential for a tight labor market to cause inflation. The unemployment rate has fallen below the non-accelerating inflation rate of unemployment. This signals the labor market is tightening according to traditional metrics that most investors look at. Just to be clear, in reality the economy is much weaker than the unemployment rate suggests. A good measure to use to determine if the unemployment rate is telling the truth is the labor force participation rate. Neither the unemployment rate nor the labor force participation rate is reality, the truth is somewhere in the middle. Usually the labor market is tight for a few years and then there is a recession. The reason is the tight labor market causes inflation which causes the Fed to raise rates which causes the credit market to tighten leading to a recession. Not many people voted for this option, but it will be a problem in the next year or two because the Fed causes the stock market to rise, good news is bad news. Wage growth means rate hikes as the punch bowl is taken away.

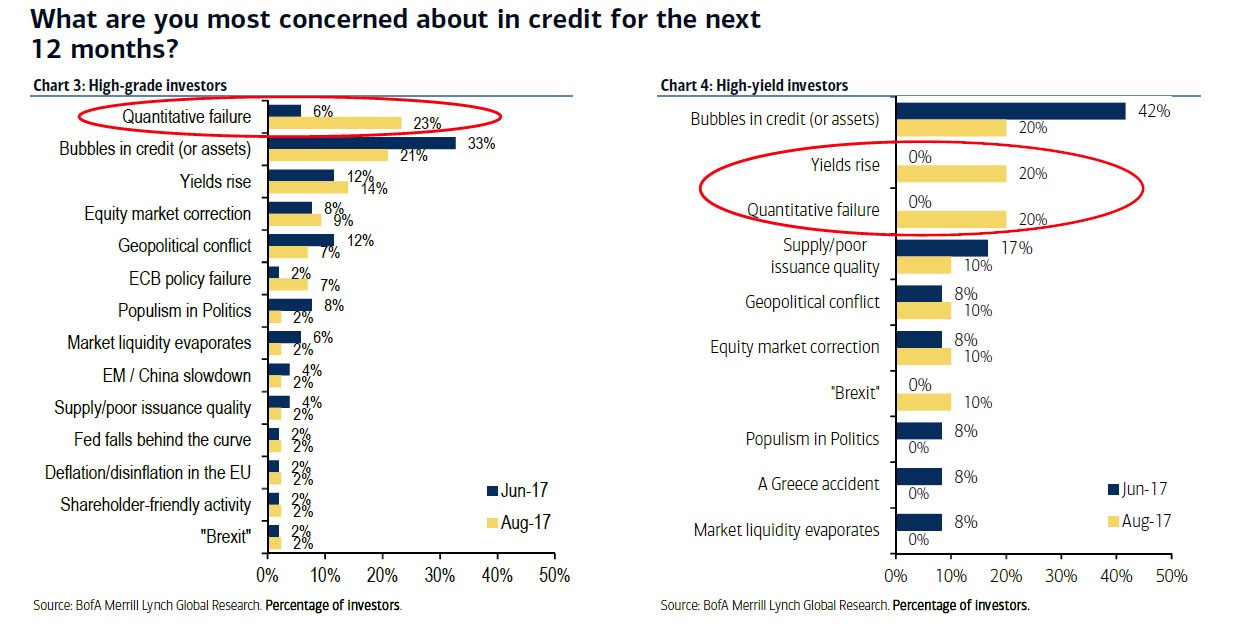

The third option which won the poll, was the point discussed earlier. If central banks all unwind their balance sheets together, it will suck the liquidity out of the market and cause a decline in asset prices. We have looked at previous polls in past articles which shows that investors don’t care about the central banks’ actions. That is consistent with how stocks and bonds have been acting as stocks are up and junk bond yields are down. The charts below suggest that there is new awareness about what central banks are about to do. It is being dubbed quantitative failure. In late 2017 to the middle of 2018 we will find out the answer to the question of whether the central banks’ quantitative failure will cause volatility in the market.

Conclusion

Our readers and bond investors are starting to get nervous about the possibility that the central bankers will end the liquidity injection. It’s possible that some people didn’t believe the central banks would go through with this because there has been strife when liquidity has been lowered previously. The later we get into the fall without an announcement of a policy change, the higher the chance that the Fed’s unwind will occur. Sometime during the unwind we’ll get the news about the ECB’s decision to taper its bond buying in January 2018.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.