UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 5 minutes

The hotly anticipated April retail sales report was released this Thursday. It was fantastic. It destroyed estimates. Estimates are usually way off when really good or bad numbers come out even if they are expected. Economists don’t want to seem outlandish and predict 10% monthly sales growth even if that’s likely. Specifically, headline monthly growth rose from -2.7% to 9.8% which beat the consensus of 5.6%.

As you can see from the chart below, the monthly 14 month rate of change hit a record high by far. This chart looks a lot like some of the rallies we have seen in stocks. We know for sure that this growth rate won’t be maintained. Investors should realize this. We will see if stock market investors know this when results cool off. Be careful of any management teams claiming the current improvement will be maintained. It won’t be in most cases.

The larger the company, the less likely for it to maintain this trajectory. That being said, retail sales will probably be very strong in the next few months especially in the leisure and hospitality industry. In theory, investors should be modeling out the next 10 (or more) years of earnings growth, not a couple of quarters. In fact, one quarter of results makes up an insignificant amount of a firm’s intrinsic value. However, we saw stocks react to short term changes last year. It’s interesting and can be rewarding to try to figure out what is actually priced in.

Details Of Retail Sales

Excluding vehicles, monthly sales growth was up from -2.5% to 8.4% which beat estimates for 5%. Of course, all the monthly comps were easy. However, the yearly comps aren’t great to use either because the pandemic affected the 2nd half of March 2020. The all important control group had 6.8% growth which more than doubled estimates for 3.5% growth. As we mentioned, the yearly stats are completely insane. Overall retail sales growth was 27.7%. Retail sales growth might be higher next month because of how weak the comp is. Other than in April, this growth rate probably won’t be hit again. Yearly clothing sales growth was 101.11%.

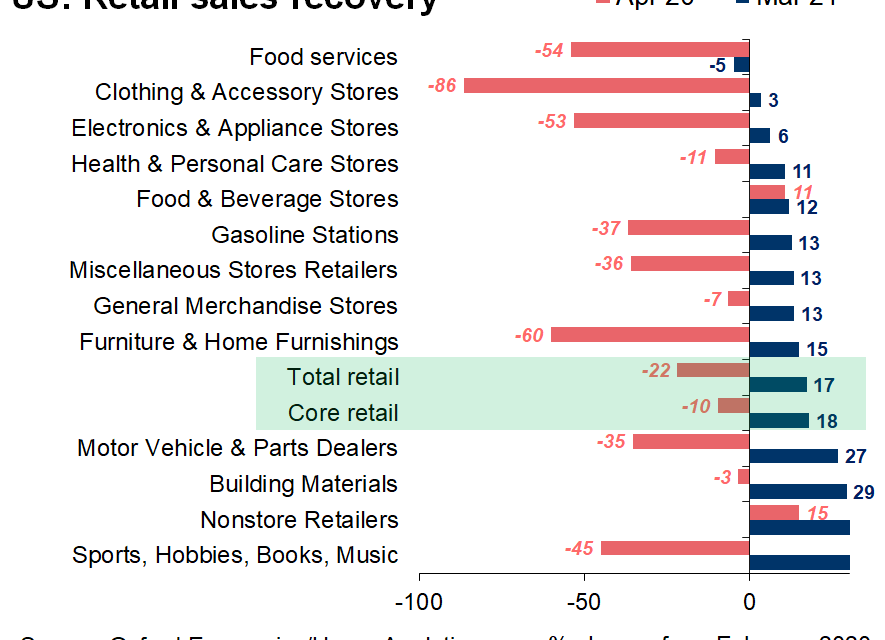

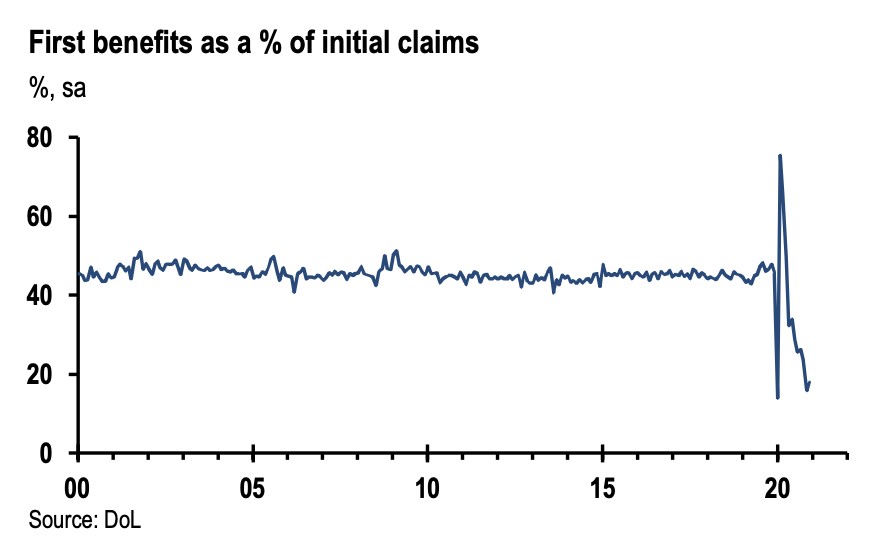

The best comp is February 2020 because it was the last month before the pandemic ruined everything. Who would have known in February 2020 that its data would be widely cited for years? As you can see from the chart above, only food services sales are down from February 2020. They are down 5% in large part because some areas like NYC still had restrictions. There is no doubt April’s reading will be above February 2020. The pandemic ended up creating pent up demand which started being unleashed in March. There is more money where that came from. Core retail sales are already 18% above February 2020. The next few months will push retail sales to new records.

Real Economy Set To Do Well

The real economy is doing well which is exactly what the stock market has been predicting since early November. Many investors point to valuations, but let’s acknowledge that investors who bought cyclical stocks in late October were perfectly right. Now we must look to the future because the promised land is largely here.

We could have a couple months left of COVID-19 before everything normalizes. Many retail traders have started leaving the equity market like we anticipated. A lot of the money is being spent on real assets, but plenty is being spent on speculation. Either this is the final bubble in financial assets or we just need to get used to rolling bubbles. It’s tough to imagine something more insane than crypto rallies, but we are always open to more craziness.

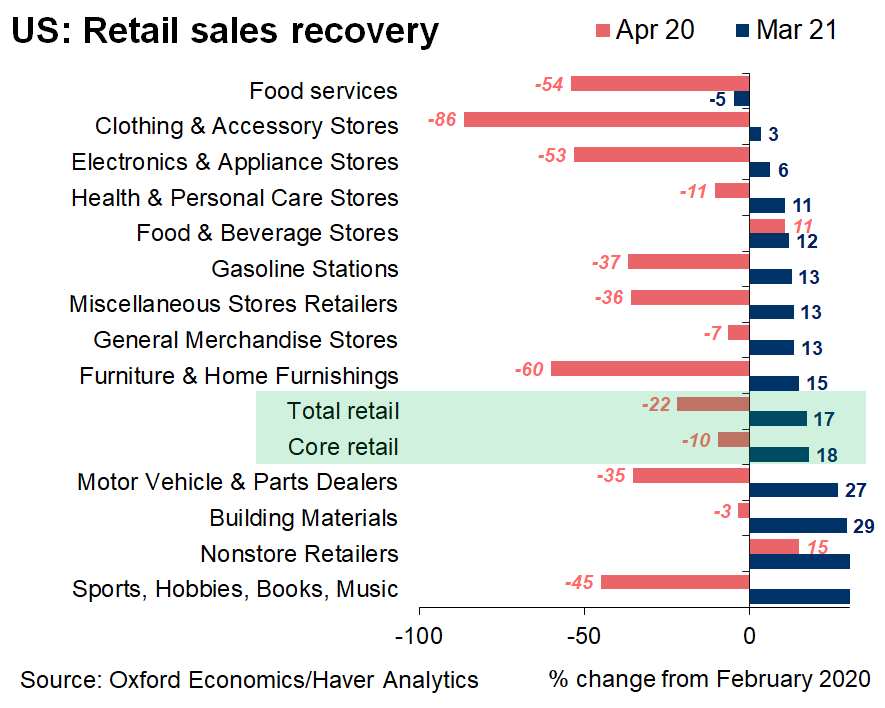

The current landscape is interesting because America looks much more expensive than the rest of the world as you can see from the relative forward PE ratio above. However, America has done the best at dealing with the COVID-19 crisis. This pandemic may have been the blow off top for relative valuations. It takes a lot of foresight to invest in some of the areas where the pandemic is the worst such as Latin America. However, you can argue making a bet on them now is like betting on US stocks in the spring of 2020. The difference now is we have a vaccine. It’s arguably an easier bet. On the other hand, you need to trust their governments to properly deliver the vaccines. It’s definitely a balancing act, but that’s how investing always is.

Jobless Claims Fall As We Expected

We said that jobless claims were going to fall sharply in the next few weeks because all the other data points have been great. We mentioned that you can’t rely on initial claims for your bearish thesis. That doesn’t work in this new world where the data is less reliable. The labor market is actually in good shape.

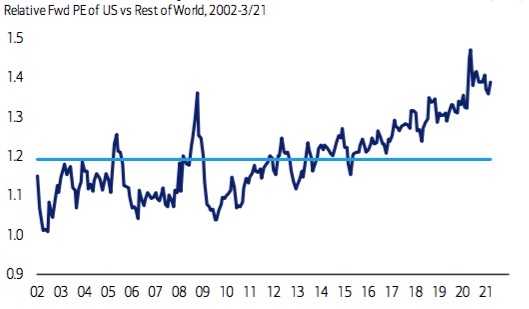

We didn’t know the improvement would come so soon, but here it is. Initial claims fell from 769,000 to 576,000 in the week of April 10th. That was below estimates for 695,000 and 99,000 below the lowest estimate. We’re closing in on legitimately good numbers! A lot of the reason initial claims are so high is more people are filing (even if they may not qualify) because of the extra $300 benefit. If we used a normalized first benefits percentage of initial claims, claims would be 330,000 which sounds about right. In the week of March 27th, the total number of people on all benefits programs fell 1.2 million to 16.9 million. We will see this total drop below 10 million by the end of May. We are on the precipice of a normal labor market.

Conclusion

Retail sales were great. The real economy is getting back to normal. Initial claims plummeted. If we had the updated number of all people on all benefits programs, it would be much lower. The US market is much more expensive than the rest of the world. Generally, it makes sense to sell when the fundamentals look the strongest. This isn’t a prediction of a decline in the S&P 500, at least not yet. It’s an increased probability of relative returns & valuations mean reverting given the macro backdrop.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.