UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

The April industrial production report was just like the retail sales report. It was worse than expected, there was a very tough comp, and the comp was revised higher. However, the comp wasn’t as tough and monthly growth was solidly positive. Specifically, monthly industrial production growth was 0.7% which missed estimates for 1.2%. However, March’s reading was revised up by 1% to 2.4%. In that sense, it was a beat unless analysts expected a large positive revision.

Manufacturing growth was 0.4% which missed estimates for 1.8% growth. The prior reading was revised up 4 tenths to 3.1%. Finally, the capacity to utilization rate rose 5 tenths to 74.9%. In February 2020, it was 76.9% which was a few points off the prior cycle peak. There is plenty of room for expansion left.

Auto production was down 4.3% because of the semiconductor shortage. Factory output increased following the winter storms. Mining production was up 0.7% and utilities were up 2.6%. As you can see from the chart below, there are now zero manufacturing sub-sectors in a recession. The manufacturing sector has heated up so much that we are looking for the cycle peak. There were numerous peaks in the last expansion. Manufacturing recessions don’t usually cause the overall economy to slump.

Bottlenecks Are Easing

If you listen to conference calls in the industrial sector, it’s clear the supply chain is under enormous pressure. Companies are getting their goods to ports ahead of time to lower costs. Companies are pulling out all the stops to lower costs and get goods shipped on time.

As you can see from the chart below, this is still a major issue. The number of anchored container ships waiting to offload goods in LA went from zero before the pandemic to 40 in February. It’s down to the high teens, but the issues aren’t over yet. We will hear about this on Q2 conference calls. However, it should be over by Q3 which should help margins.

Everyone Sees Higher Inflation

The economy has generated higher inflation this year which has spurred the movement from tech stocks to energy stocks. Energy stocks might do even better because oil has been one of the few commodities that hasn’t spiked sharply. Portfolios with just 2% or less in energy weren’t safe from the correction in tech. Higher than trend inflation is pretty much a given now that the strong April CPI report came out.

The questions now are what CPI will peak at, when it will peak, and how long it will stay high. Based on base effects, CPI should peak in May somewhere in the +4% range. Inflation should stay elevated for a few months. We don’t know what it will settle at following this spike. If it settles above 2.5%, that’s a problem for the Fed. It might need to raise rates earlier than expected.

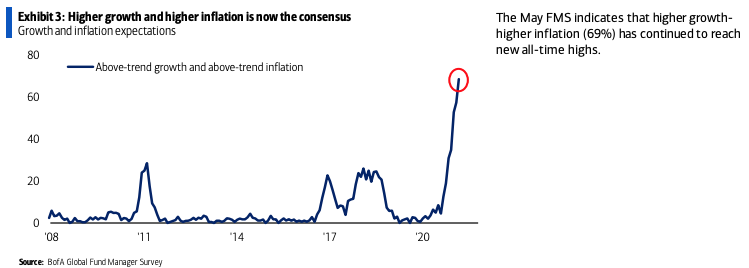

As you can see from the chart above, 69% of fund managers believe there will be higher than trend growth and inflation. At this point, we wonder who still thinks there will be at or below trend growth given the reopening, the huge stimulus, and the spike in consumer spending. Just because the consensus is optimistic, doesn’t mean it won’t happen. The issue is it is fully priced in. That explains why the Russell 2000 hasn’t done much in the past few months.

Since January 22nd, the Russell 2000 is up 1.15%. That’s not terrible of course. However, in the prior few months, the market exploded. Investors should be focused on what the economy will look like following the boost after the reopening. The end of the pandemic and the stimulus are now fully priced in. Of course, this varies among stocks. Some stocks might not be fully pricing in the recovery and many are overpricing it. That’s because investors have different perceptions of each business/industry.

Tech Is Still Crowded?

As you can see from the chart below, in May tech was the 2nd most crowded trade which is surprising given the decline in tech stocks in the past few months. Essentially, this must refer to the big tech stocks, not the innovation stocks. The ARK Innovation ETF is down 34.2% from its peak, while the XLK tech ETF is down 6.2% from its record.

Bitcoin was named the most crowded trade by a lot. We’re surprised to see such a big change from April because bitcoin hasn’t done that well recently. There has been tons of volatility in the past few months. This isn’t a crowded trade among fund managers. It’s crowded among retail investors. It’s amazing how pervasive the adoption has been. You’d think with all these speculators, that it could be used as a currency, but it’s still stuck as a “store of value.” How much value it stores is up to the reader to decide.

Finally, we have ESG investments. This probably consists of green energy stocks and index/data providers that benefit from the trend. There are a select few companies in the financial sector with extremely high profit growth due to the ESG movement. Critics point to these profits as evidence of this being unsustainable. If there are ulterior motives, it changes the game. Of course, this type of conflict is ironic because that’s part of what ESG tries to get rid of. The original creators of ESG likely never would have considered it a market factor. This shows how far it has come for better or for worse.

Conclusion

The industrial production report was solid. No sub-sectors are in a recession which is rare. We could actually be a few quarters away from a manufacturing recession. The supply chain woes continued in May, but they are easing. Everyone sees above trend growth and inflation which is why good results stopped pushing up the Russell 2000 in February. Bitcoin is the most crowded trade. Everyone got involved. This is unprecedented. This crypto bubble is much more pervasive than the 1990s tech bubble. Maybe the ESG trend won’t last. Generally, when companies have ulterior motives, the house of cards ends.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.