UPFINA's Mission: The pursuit of truth in finance and economics to form an unbiased view of current events in order to understand human action, its causes and effects. Read about us and our mission here.

Reading Time: 4 minutes

Let’s start with the most obvious confusion. JP Morgan stated the consensus is if the Democrats win the 2020 election it will be bad for U.S. stocks, but they view it as “neutral to slight positive.” That does not compute with the chart below which shows their 2021 earnings projection if the Dems win. Even if you add $8.5 because of China tariff de-escalation and $1 in infrastructure spending, the net change is -$4. That’s confusing. This is emblematic of the stock market itself as negative news is being cast aside.

The great thing about markets is no one knows what is priced in. Sometimes there are extreme sentiment moves which don’t have anything to do with fundamentals. When people who act as analysts instead of investors try to rationalize prices, it’s like trying to fit a square peg into a round hole. There are two options for these analysts: they either say the market isn’t pricing reality and bet against the trend or they come up with an excuse as to why the markets are up/down. You cannot ignore that markets can become dislocated from reality. You also can’t expect perfectly rational price action once you get involved in a trade. The fun part is you never know for sure if the market is crazy or if you are wrong.

The two lessons these analysts need to learn are the following: 1) if the market is acting irrationally, be flexible. Don’t go all in on a trade where the market makes no sense. Sometimes the best trade is to watch and do nothing. 2) you don’t need to rationalize the irrational. Anyone can come up with a narrative, but that doesn’t make it right.

If you assume JP Morgan’s election model is accurate, the S&P 500 is still trading at a 20 forward PE multiple as of Monday’s close. You need to lean heavily on low interest rates to justify such a high PE ratio. While stocks usually have a high PE ratio in recessions, this estimate is already expecting a solid rebound. Stocks should be expensive based on 2020 EPS, but not necessarily on 2021 EPS.

Investors Should Root For A Mixed 2020 Election

On the positive side, if the Democrats don’t win the Senate, a tax increase might not be passed. A tax hike could hurt S&P 500 EPS by $14; this isn’t a one time event. On the negative side, Joe Biden is running on being tough on China, so it won’t be smooth sailing on trade no matter who wins. De-escalation of the tariff war (if that happens) with China is projected to help 2021 EPS by $8.5. The infrastructure plan probably can pass no matter who wins the election. That will only help EPS by $1 though.

Investors should always root for a mixed government because less extreme legislation gets passed when one party doesn’t control the Congress and White House. As you can see from the chart above, the S&P 500 has returned 17.2% per year since 1950 when there is a split Congress like there has been since 2018 when the Democrats won control of the House. GDP growth is irrelevant in this scenario because markets focus on certainty and because legislation that’s passed in a specific term doesn’t necessarily impact the economy right away. Markets react to news instantaneously.

S&P 500 Is A Quality Growth Index

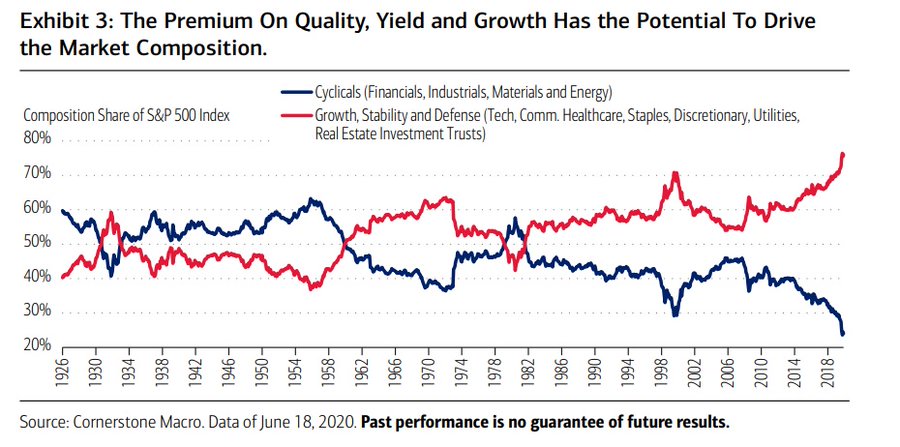

The S&P 500 has transformed itself in the past 10 years. It has become a quality growth index. There’s less of a need to buy those factors. You can just buy the index because it’s so heavily weighted towards tech and healthcare (among others) as you can see from the chart below. Ironically, the S&P 500 could underperform if there is a cyclical upswing since it is low on cyclicals. It would be hurt by inflation and higher rates. Essentially, it would underperform or be hurt by a changing macro environment.

Many tech investors think tech is doing well because growth companies are the future. There certainly is truth to that, but they are thriving in this environment because of low rates and low inflation. Investors are starved for growth. Energy and materials companies don’t do well with low commodity prices and banks don’t do well with low rates.

Labor Market Context

It would be incredibly bad if the labor market stopped improving because the unemployment rate is still above the peak in the last recession. As you can see from the chart below, this recession was so bad that the CBO doesn’t expect payrolls to recover to the depth of the 2007-09 recession until 2021. It won’t recover to the depth of the 1980s recession until late 2022. This recovery is worse than most recessions on an absolute basis.

Economists view permanent job losses as a more important figure than headline job creation. Even though the economy is recovering, because so many newly unemployed people viewed their job losses as temporary this spring, the job losses are only now starting to switch from temporary to permanent. It’s a race against time as the quicker people get their jobs back, the fewer will lose their jobs altogether. These workers who lose their jobs won’t be permanently unemployed. It’s just that it can take many months to find a job in a weak economy. It’s better if they never lose their jobs, just like it’s better if people get unemployment benefits instead of losing income for a significant chunk of time.

Conclusion

Even if you take a rosy look at the economy under a scenario where the Dems win and end the trade war, the stock market has a 20 PE. If the benefits from de-escalating the trade war with China are too optimistic, the stock market could be extremely expensive after a tax hike. If taxes aren’t raised, stocks will be cheaper. Stocks do better when neither party controls the government. The S&P 500 has become a growth and quality factor investment. So many jobs were lost, this recovery looks worse than most recessions. The goal is to avoid employees and workers severing their relationships, forcing people to find a new job in a weak economy.

Have comments? Join the conversation on Twitter.

Disclaimer: The content on this site is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be based upon an independent investigation by a certified professional. Please read full disclaimer and privacy policy before reading any of our content.